6 Co-Brand Card Marketing Insights Inspired by Bond Brand Loyalty Research

Believing in the principle of “insight to action,” the Media Logic team examined recent Bond Brand Loyalty research findings about loyalty and credit cards and found them to have relevancy as valuable co-brand card marketing insights, too.

Here are a few observations culled from several waves of research:

1. There is a continued decline in satisfaction.

Only 23% of loyalty members/credit cardholders are very satisfied with their programs’ response to COVID-19 (-7% from previous survey.). Credit cards are falling short of non-tender loyalty programs in demonstrating relevancy of rewards/benefits, commitment to local community, sending relevant communications and staying connected. Top consumer expectations in light of COVID-19 are savings of money and time, great service and an added sense of security.1

2. Only 45% of customers think rewarding loyalty is important.

Research fielded in May 2020 underscores the prevailing mindset and decline in consumer confidence. However, Bond’s loyalty experts2 believe that “loyalty will return to its important role of enabling experiences that treat best customers best” as consumer confidence is restored across time. In the meantime, what can brands do?

Media Logic recommends brands be proactive: don’t go silent, but continue instead to communicate in a variety of channels focusing on pragmatic benefits that resonate given the environment. If your program can’t deliver on changing expectations, we think now is a good time to research your portfolio and introduce and educate on new benefits driven by current needs, particularly any benefits exclusive to co-brand cardholders.

3. There’s a gap between perceived and actual program participation.

Bond regularly asks credit cardholders about their level of program participation, which is the best measure of success. Surprisingly, 61% of cardholders surveyed indicate they participated in the past 12 months – that is, they earn and burn rewards—while in actuality, 78% actively participated. The gap between perception and actual behavior is a consistent finding3 across 2018-2020.

Timely and frequent communication after an earn/burn event may be all that is needed to reinforce the value a cardholder derives from the program. Keep it simple and, at the very least, provide more than the expected annual rewards status communication. Remember, you are up against new players like Apple Card, which delivers simple text updates on a daily basis.

4. Cohorts have both similarities and differences in expectations.

The new normal indicates both similarities and differences between how cohorts view loyalty and what they expect from retail brands specific to COVID-19 precautions, and some of the expectations2, we believe, can impact loyalty and co-brand programs as they are re-imagined for future relevancy:

- All cohorts (particularly younger loyalists) want contactless payment options, a trend we’ve been on top of as we assist brands in communicating contactless value.

- Young consumers place greater emphasis on the off-premise retail experiences like curbside, delivery and shopping apps.

- Older cohorts index higher on retail protections – like providing hand sanitizer, special shopping hours – that benefit the most vulnerable.

From Media Logic’s experience working with co-brands who seek ways to distinguish the card and improve the exchange of value between cardholder and brand, we see that the usual sponsorships and promotions are changing. Bond’s insights will help brands understand the loyalty and rewards cardholder mindset driving change.

We see an opportunity for co-brands to find ways to “sponsor” timely value-adds to cardholders, including priority shopping lines, shopping by appointment, senior hours, merchandise delivery, branded sanitation stations (offering hand-sanitizer, wipes, single-use pump towels, single-use masks, etc.) and help securing hard-to-source merchandise.

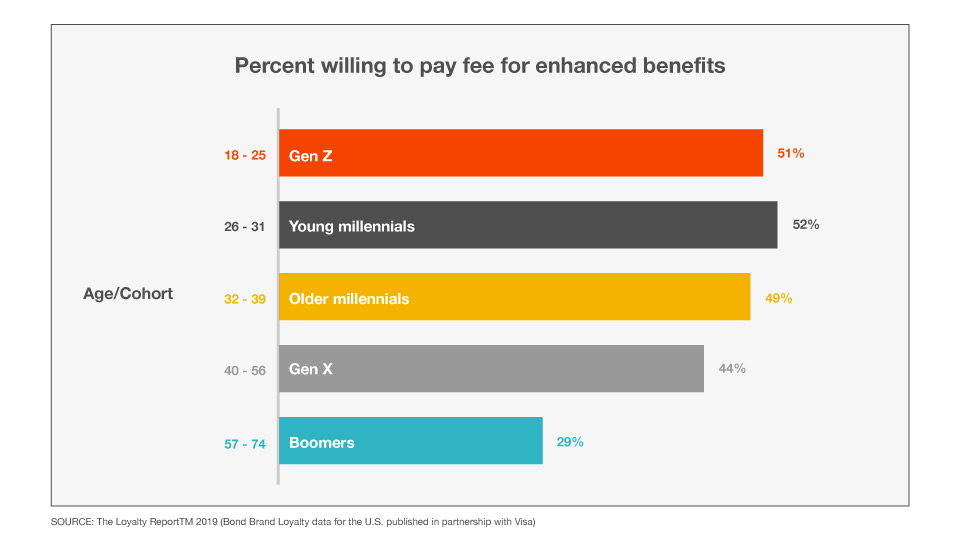

5. Fees for enhancements are acceptable to cardholders.

An important related card marketing insight: Bond and Visa research from 20193 show credit cardholders are “willing to pay fees for enhanced benefits.” This is seen across multiple cohorts. Therefore, brands can levy a reasonable fee to help fund a new, enhanced exchange of value for these programs.

6. Grocery brands show how to bolster loyalty.

In May, Bond took a focused look4 at the grocery sector, possibly the most visibly impacted retail sector during the pandemic. We find the program changes Bond identified, although specific to grocery retailers, are relevant across all loyalty and co-brand sectors:

- Tweak rewards – Make it easier, faster and more economically valuable with point redemption for free products in selling channels, and make it easier to pool/share program points (extracting more value from the program).

- Add new benefits – Develop new assets that were previously unavailable (e.g., new redemption options and partnerships).

- Relax program terms – Permit members to use the program in ways that were previously unavailable or prohibited.

- Waive fees – Allow members to leverage convenience services, like free delivery and free bags, during this time of need. (Note: There is a notable difference between what is perceived as a “nuisance” fee and the fee for enhanced value that cardholders are willing to pay.)

- Add new conveniences –Introduce services that make the shopping experience more convenient (e.g., app checkout, in-app shopping lists, auto-replenishment, etc.).

- Build in community support – Introduce ways members can help front-line workers and disadvantaged members of their communities through the loyalty program.

What to expect into the future

Bond points out that we can “expect continued economic hardship with a focus on survival and perseverance by a large portion of the population.” Loyalty programs will need to focus more on providing immediate and tangible monetary value. The trends4 identified in Wave 4 (5/20) can be a set of guardrails as you re-imagine and communicate enhanced loyalty programs:

- Access – Tiers within programs usually provide new access to features and benefits. Expect less luxury focus and more focus on the practical, such as shopping by appointment to avoid wait times at store entry.

- Data and personalization – Use data to understand new attitudes and behaviors. Address unique needs for future success. Bond notes, “The pandemic has generated new purchasing behaviors and product preferences and new ways in which products are being used.” Provide offers, experiences and content to keep members and cardholders loyal.

- New partnerships – Find partners who amplify and make your brand experience better. Bond notes new emerging partners around health and safety, convenience, trust and consolidation of everyday shopping needs.

- Pay-to-play – Card issuers can expect continued growth in fee-based and subscription services and consumer willingness to pay for services: “A whole new population of consumers… have warmed up to subscription models across multiple sectors. Bold operators may even choose to guarantee supply for in-demand, limited-quantity items.”

- Drive to community – Bond sees continued emphasis on loyalty programs bringing like-minded members together via digital connections and socializing. Furthermore, its experts observe that loyalty programs have fostered “self-betterment and greater good for communities at large.” This drive to connect and to better community through a valued brand is expected to continue beyond COVID-19.

- COVID-19 and the State of Consumer Loyalty. Bond Brand Loyalty Data Lake and State of Consumer Loyalty Tracking Survey. Waves collected March 16, March 20 and April 22.

- High–Frequency Retail Edition: COVID-19 and the State of Consumer Loyalty. Bond COVID-19 State of Consumer Loyalty Pulse Survey. Wave 4 collected May 8.

- The State of Loyalty: A Data Lake Worth Exploring. Bond Brand Loyalty Data in partnership with Visa. The Loyalty Report 2019, 2020.

- Has Grocery Shopping Changed Forever?