2025 AEP Analysis: Five Takeaways That Signal a Shifting Medicare Market

The Centers for Medicare and Medicaid Services (CMS) recently released Medicare Advantage (MA) enrollment data following the 2025 Annual Election Period (AEP). This offers us the first opportunity to analyze where the market stands and where it’s headed.

While 2024 AEP still felt like part of the MA expansion era, albeit a slower one, 2025 AEP shows a real pivot. This wasn’t just another “mixed bag” year. It was the clearest sign yet that the period of rapid growth is behind us. What remains is a reshaped market, defined more by selective retention, profitability pressures and strategic pullbacks than by enrollment races.

Here’s a look at the five biggest takeaways from our 2025 AEP analysis. Want a walkthrough of the data? Scroll to the bottom for a video explainer from Media Logic Group Director Josh Martin.

1. The “Great MA Migration” Is Over

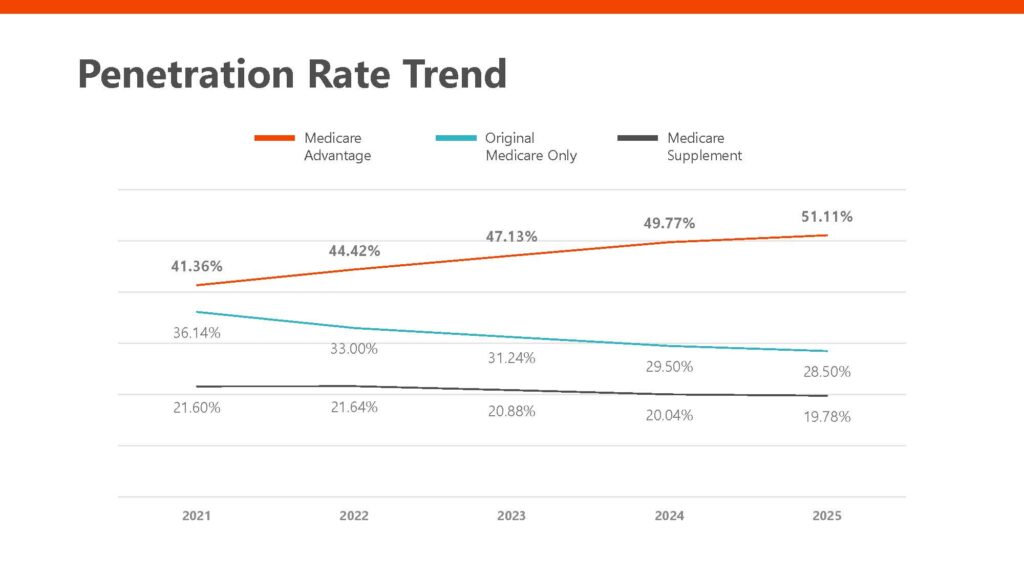

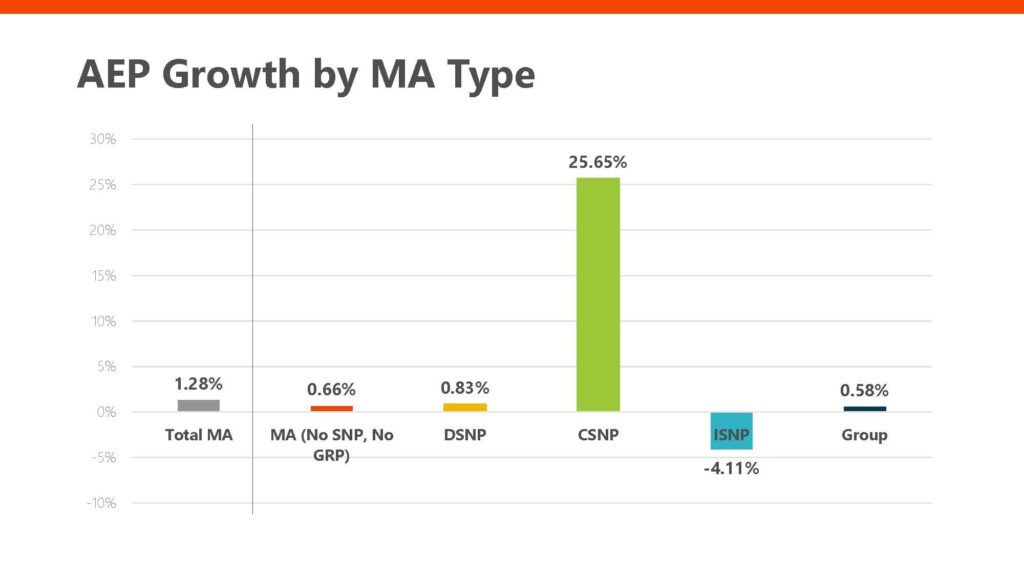

MA enrollment grew just 1.28% from December 2024 to February 2025, a significant slowdown from the double-digit growth seen in previous years. While the market added more than 435,000 members, the days of rapid expansion are clearly behind us.

The penetration rate continues to climb, but at a more modest pace, reaching 51% of all Medicare beneficiaries. That growth curve is flattening, suggesting that we’re nearing market saturation.

2. C-SNP Is Still in Growth Mode

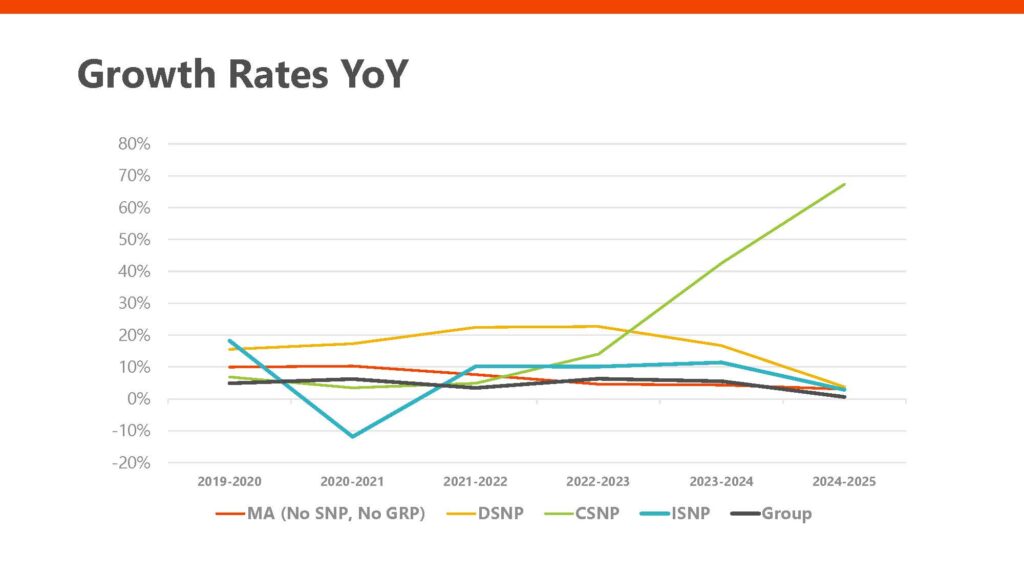

Chronic Condition Special Needs Plans (C-SNPs) were the clear outlier this year, growing by more than 25% during AEP. This marks the continuation of a multi-year trend of strong growth in this segment. However, it’s worth noting that C-SNPs still represent just over 3% of the overall MA market.

3. All Other MA Types Are Slowing

Dual Eligible Special Needs Plan (D-SNP) growth dropped from double digits to under 4%, and Institutional Special Needs Plans (I-SNPs) saw a decline. Group plans and standard MA plans also experienced stagnation. This suggests that insurers are becoming more selective – growth for growth’s sake is no longer the strategy. Profitability is taking center stage.

4. Deliberate Membership Reduction

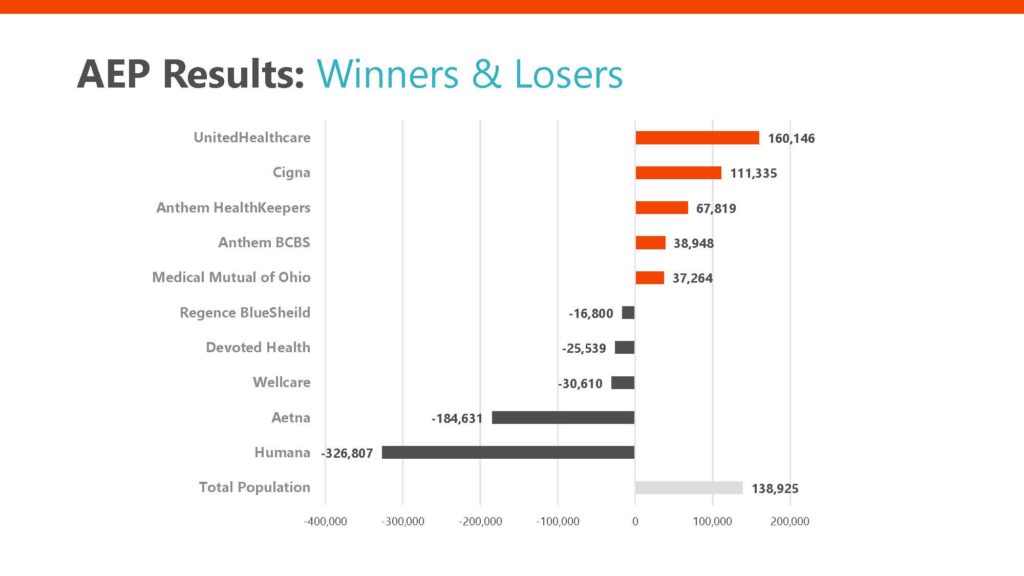

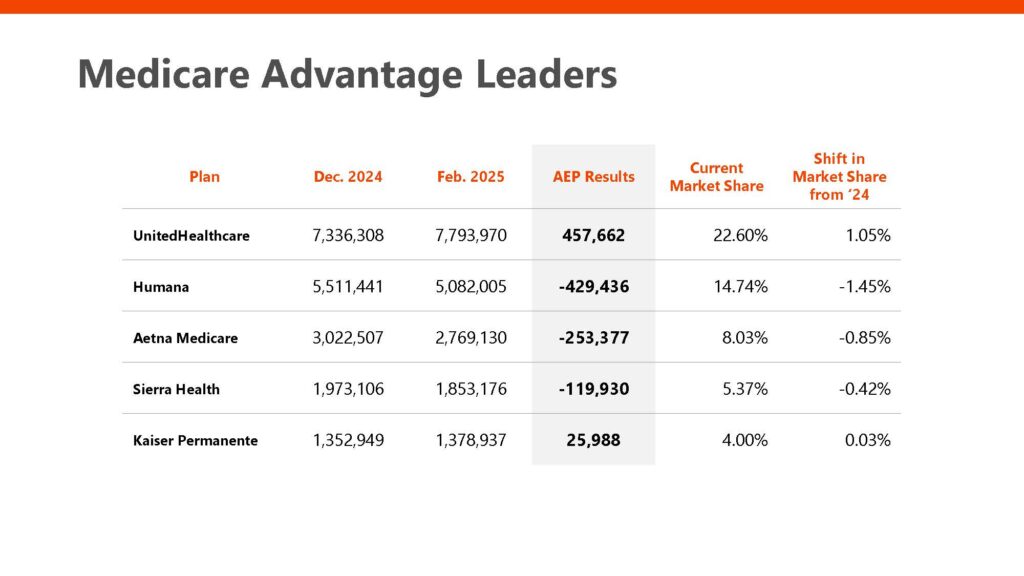

Humana lost over 326,000 members during AEP, with Aetna, WellCare and several regional plans also posting losses. Much of this appears to be strategic. Plans are pulling back on unprofitable segments in response to rising costs, lower star ratings and tightened CMS policies.

We’re seeing a clear pivot: growth is no longer the north star. For many plans, especially large nationals and regional carriers, the new goal is sustainable profitability.

5. UnitedHealthcare Continues to Grow

UnitedHealthcare added nearly 460,000 new members, extending its lead as the market share leader. Even when isolating for standard MA plans (excluding SNPs and group), United still saw gains.

AEP Analysis: Video Explainer

Want us to walk you through the data? Media Logic Group Director Josh Martin explains the charts and the data from our 2025 AEP analysis below.

Compared to last year’s AEP, where many plans were still jockeying for position in a growing market, 2025 was more about defensive plays and recalibrated strategies. Plans like United leaned into growth in key areas like C-SNP, while others like Humana and Aetna scaled back intentionally. What’s becoming clear is that we’ve entered a new phase in the Medicare Advantage lifecycle—where smart targeting, retention and financial sustainability are replacing the once-dominant prioritization of growth.

Got questions about our 2025 AEP analysis and what this means for the year ahead? Reach out to Media Logic today.