The Evolution of Online Payment Systems: Dwolla as a Challenger to PayPal

Way back in 350 B.C., in the essay Politics, Aristotle postulated the thousands-years-old barter system would evolve into the use of physical currency. He wrote, “ …for coin is the unit of exchange and the measure or limit of it.”

Today our “money” is changing very quickly into a virtual series of zeros and ones. A digital currency that is easy to store electronically. Easy to send. And easy to receive.

As ecommerce payment systems mature, it costs less to maintain and transfer money, and some of the early players in this space will have to reevaluate their business models to remain competitive.

In North America, almost 90 percent of online B2C transactions are made via Electronic Data Interchange (EDI). Beyond card transactions, the largest and most commonly known and utilized EDI platform is PayPal, which has seen its net total payment volume grow 21 percent to $41 billion in 1Q2013 alone. This growth is fueled mainly by the predominant worldwide use of PayPal in eBay transactions.

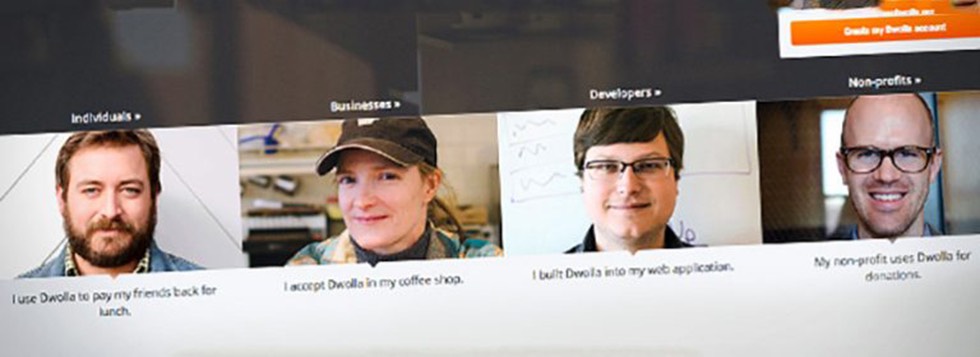

The other side of the coin, however, represents PayPal’s overall EDI market share, which is decreasing due to a proliferation of e-payment competitors. Among the 50 or so challengers, there are two or three we’re keeping an eye on right now. The first is Dwolla.

Dwolla, whose name is a slangified portmanteau of sorts between the words “dollar” and “web,” represents a formidable alternative to PayPal. Designing its own network from the ground up, Dwolla bypassed many of the traditional channels and built something cheaper, faster and safer than anything that previously existed. This creates a huge channel and market pricing advantage for Dwolla.

Dwolla, whose name is a slangified portmanteau of sorts between the words “dollar” and “web,” represents a formidable alternative to PayPal. Designing its own network from the ground up, Dwolla bypassed many of the traditional channels and built something cheaper, faster and safer than anything that previously existed. This creates a huge channel and market pricing advantage for Dwolla.

- Dwolla charges only 25¢ per transaction, and any transaction of $10 or less is free. Compare this with the average 2.9 percent + 30¢ that PayPal charges on each “goods and services” transaction. (PayPal allows you to send money to friends and family from a bank account for free.)

- Both PayPal and Dwolla allow you to move money to a bank account. Dwolla does this as quickly as the same day (however, in some circumstances it can take up to three days); while PayPal consistently takes 2-4 days to move money.

- Dwolla allows mass payments of up to 2,000 recipients; PayPal limits the number of recipients to 250.

- PayPal limits total daily transactions to $10,000. Dwolla sets its per transaction limit at $5,000 for personal accounts and $10,000 for business. However, in special circumstances, it allows organizations to transfer up to $50 million in a single transaction… yes, for just 25 cents!

It is difficult to innovate in the payment space, but Dwolla’s proprietary network allows users to send money to email addresses, phone numbers and social connections on Facebook, Twitter and LinkedIn and to any business that chooses to accept it. You can send money to anyone – but recipients need to set up a Dwolla account to claim funds.

Dwolla’s clear competitive edge is pricing. To accomplish this, business costs need to be kept low, and Dwolla built its network so that only Dwolla transactions and bank account transfers can fund accounts. Credit cards are not accepted. Dwolla, Inc., is an agent of Veridian Credit Union, and it pools all funds associated with accounts in a single account at Veridian Credit Union. Monies held in a Dwolla account are not insured.

Regardless of the platform, online payment systems have their commonalities, and each uses a proprietary web and/or mobile app. Google, however, is breaking away from that mold to offer a more ubiquitous solution with Google Wallet. Not to be outdone, PayPal just announced PayPal Galactic, its study of the opportunity for creating a universal space currency and payment platform… and of how banking systems and currency would need to change to adapt to a cash-free interplanetary society.

Aristotle would be humbled.