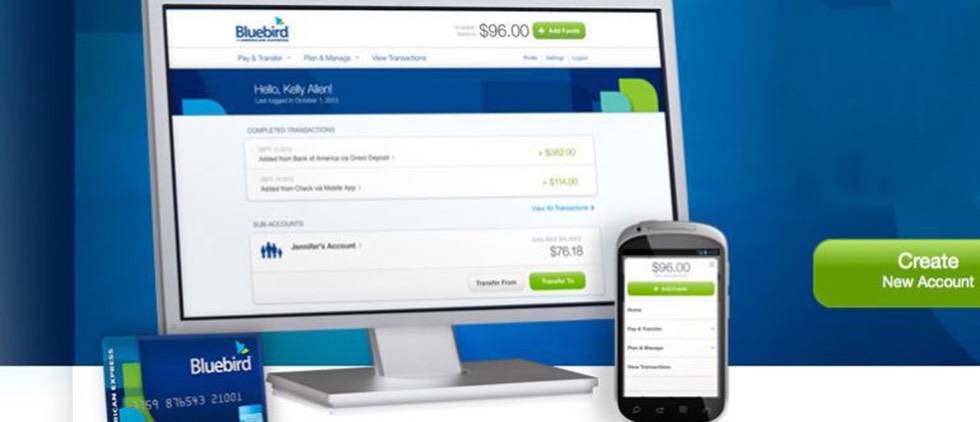

At-A-Glance: Amex Bluebird – Now an Alternative to the Savings Account, Too?

Last month, American Express introduced SetAside – an add-on feature to its Bluebird prepaid product. Currently positioned as “Your Checking and Debit AlternativeSM,” Bluebird is aimed at displacing traditional checking and debit card products that charge monthly/annual fees and require minimum balances. And now, with the launch of the SetAside Account feature, Amex takes the product beyond a checking and debit alternative into a savings alternative, as well.

Last month, American Express introduced SetAside – an add-on feature to its Bluebird prepaid product. Currently positioned as “Your Checking and Debit AlternativeSM,” Bluebird is aimed at displacing traditional checking and debit card products that charge monthly/annual fees and require minimum balances. And now, with the launch of the SetAside Account feature, Amex takes the product beyond a checking and debit alternative into a savings alternative, as well.

SetAside allows Bluebird cardholders to… wait for it… set money aside for future needs. Whether you want to put money away for the holidays, save for vacation or other large ticket item, etc., SetAside allows you to move funds from your main Bluebird account into your SetAside account with one-time or recurring transfers. Your funds aren’t touched until you’re ready to use them, and when you are ready, you simply move them back into your Bluebird account. It’s pretty simple. And unlike many savings accounts, because SetAside is part of the Bluebird account, there are no monthly/annual fees or minimum balances required.

We took note of SetAside when we saw this email communication introducing the feature to existing Bluebird accountholders:

The branding and design are simplistic, and the messaging evokes a sense of empowerment:

- “a useful tool that can help you put money away toward goals that matter to you;”

- “transfer funds when you are ready to spend;” and

- “it’s your money, you’re in control.”

Of course, there is nothing new here. Amex has simply done what it does best: take tried and true banking product structures and add relevant messaging and a spin. This particular spin extends the appeal of the product to the un/under-banked, the target demographic, at a time when prepaid has become one of the fastest-growing products in the payments industry.

Email communication sourced from Competiscan.