Credit Card Marketing Offers Reflect a New Normal for Back-to-School Shopping

For parents, kids and teachers around the country, three words strike a certain type of anxiety this year: back to school. Or would that be back to the living room? Or back to mom and dad’s home office? Or the kitchen?

School is already starting in many districts, and that will only increase as we approach Labor Day. In normal times, we tend to see back-to-school credit card marketing offers and promotions in July and August. These mainly target parents in an effort to drive traffic to specific merchants for new clothing and school supplies. But of course, these are not normal times.

For over a decade now, Deloitte has published an annual back-to-school survey of parents and their spending habits going into the summer months. The findings this year revealed a significant shift, not in how much is being spent, but rather changes in what’s on the shopping list.

A few key findings from the survey show the following:

- Spending per student was expected to remain flat, but 40% of parents expected to spend less on traditional school supplies.

- 28% planned to spend more on technology and less on apparel and other traditional items.

- Parents planned to spend 37% of their budget online, which increased by 8% over 2019.

We took a quick look at creative samples from Mintel Comperemedia (as well as our own inboxes) and discovered some of the Deloitte findings and actions mirrored in this year’s back-to-school credit card marketing.

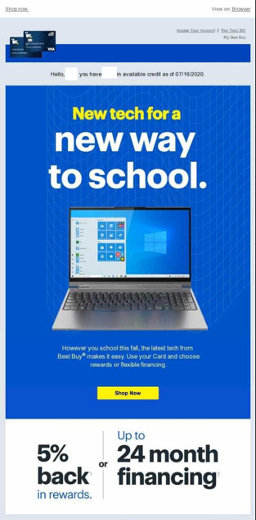

This email from the Best Buy credit card from Citibank, for example, seems to perfectly encapsulate our current moment in time relative to back-to-school shopping. The existing cardholder offer provides a choice of 5% rewards or financing, and it has a very simple layout with a headline that says a lot in just a few words.

American Express recently sent a Membership Rewards email with an Amazon.com offer for $20 off back-to-school items. They also plug back-to-school redemption items, including technology. It’s a great offer strategy for Amex, provide something for everyone: a spend-and-get offer and redemption options through Membership Rewards.

We also observed this email from the Sam’s Club MasterCard that takes a more traditional approach. They lead with “school supplies, clothing and more!” While there are no mentions of technology spending, the email does have a single focus message that drives online.

These are just three examples (and Comperemedia cannot capture everything), but it’s interesting that the observations on spending that Deloitte highlighted are clearly reflected in these credit card promotions.