How Capital One and Walmart Encourage New Card Migration and Usage

Sometimes when you put two powerful brands together, the brand combination can result in a complicated quagmire of communications. (Say that three times fast!) But when Walmart and Capital One partnered to create the new Capital One Walmart Rewards Credit Card, they did a great job of keeping it simple — at least from the marketing materials* we were able to gather. In fact, we were pretty impressed with the clean and clear materials designed to help with migration, acquisition and EMOB communications.

Starting in October, cardholders of the Walmart Credit Card issued through Synchrony were automatically migrated to the new Capital One card, and acquisition efforts for new cardholders began. Switching cardholders to a completely new product is always tricky, but the announcement direct mail we found was a lesson in clarity.

We liked not only the simplicity of the letter but also the use of timelines to walk cardholders through the transition and reduce any confusion and trepidation.

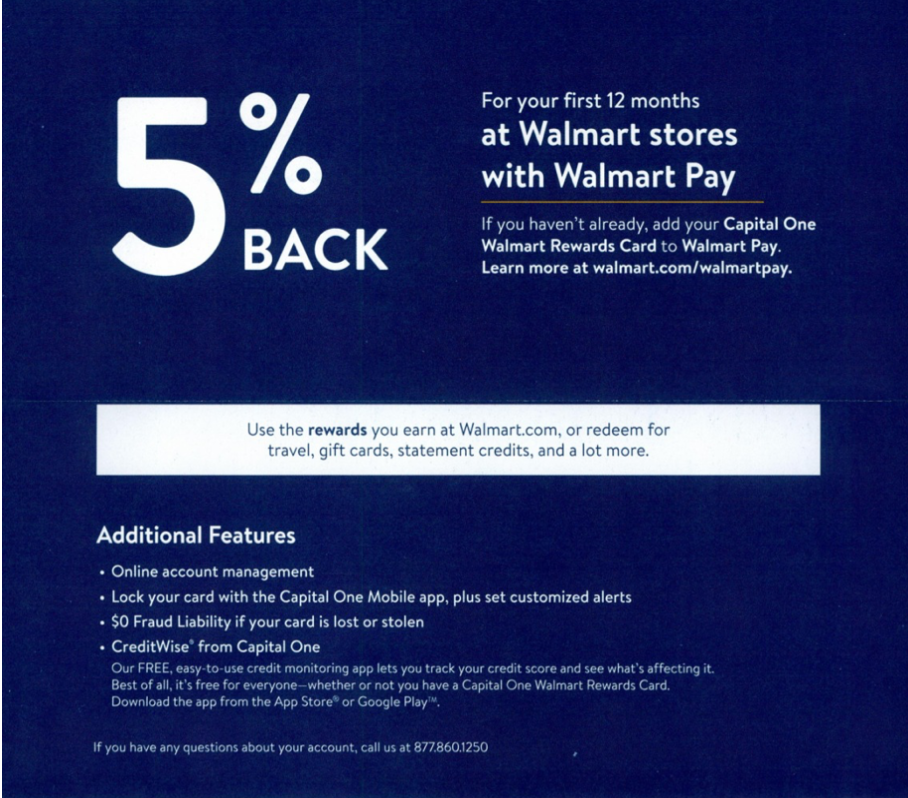

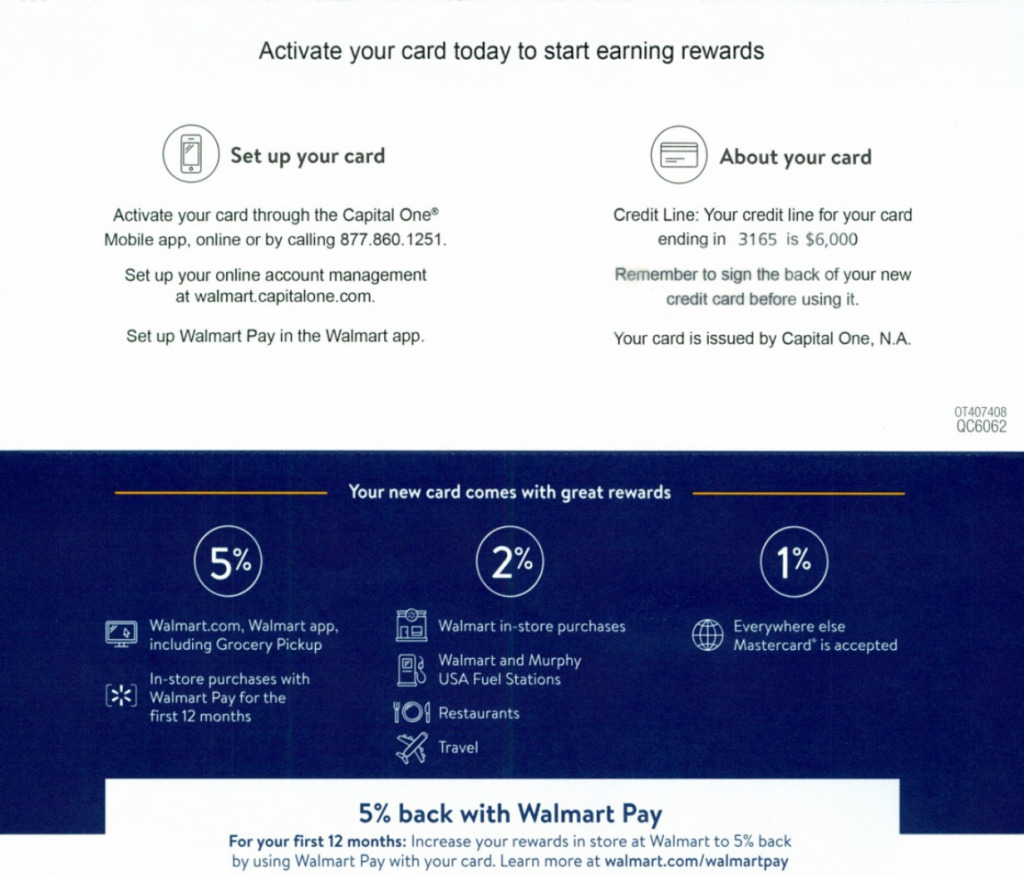

Clear communications continue with the new card carrier. (Again with the alliterations!) Instead of inundating the cardholder with details, the carrier keeps the messaging clean and simple, with a focus on activation and the earning structure.

What really struck us, however, was the EMOB email stream that followed. Each email in this series has a singular message, presented in a short, easy to scan format with a clear call to action.

These emails help drive home key EMOB tenets, from reinforcing the value proposition to encouraging world spend and promoting various types of sticky behavior (digital wallets, bill pay, etc.). Presenting these EMOB messages via email is not only a cost-effective approach but also a reinforcement of the brand’s focus on digital convenience, including the ability to connect the card to Walmart Pay and sync with Capital One’s mobile app.

All in all, we were very impressed with the simplicity and clarity of the card’s initial communication efforts. Instead of burying the messages under two distinct and ownable brands, Capital One and Walmart wisely chose to stay out of the card’s way, which resulted in a powerful migration and usage campaign.

* SOURCE: Mintel Comperemedia, October-November 2019