Chase Makes Conversion Less Painful with Simple Best Practices

Credit card conversions happen for a number of reasons. Products may be introduced or discontinued. Customers can be upgraded to other cards. Co-brands decide to move portfolios to new issuing banks. Or there might be a switch in the payment network.

One of the big pain points about a plastic reissue is that the expiration date and sometimes the account number will change. That might seem minor at first; after all, they are just numbers on your card. But given how we use our cards today, it can create a lot of work.

It’s extremely convenient for consumers to save card information on different shopping websites for faster checkout, and with increasing numbers of subscription services, a stored card is often required. Personally, I find this system works great. My monthly Netflix bill is paid, my phone bill is paid, my annual renewal to Consumer Reports is paid, and purchases from Amazon are charged all without reentering a long 16-digit number. No problem. That is, until the account number changes.

I recently lived through this after Chase decided to shift more of its card volume to Visa. I’ve had a Chase Slate MasterCard in my wallet for many years, and the issuer recently let me know that I’d be converting to a new Visa card. This meant that my account number would have to change. (By the way, if you want some information on what those numbers on your card mean, Mint has a great infographic about it.) As a financial service marketer, I know the best practices needed to drive activation after a reissue, and I was really pleased to see how Chase approached this process.

Pre-notification

Using “pre-notification” communications to get cardholders ready for the conversion is critical to success. If they know that it’s coming, they can be prepared and plan ahead. Here, Chase did an excellent job.

About a month before the conversion, I received an email and a letter telling me that my existing card would be replaced with a new Visa card. That’s fairly standard, but Chase took one other big step to help make this whole process easier to manage.

Included in the letter and email was a list of all the online merchants where I had used this card in the last year. Not only that, but Chase gave me the names of the merchants, contact information for each of them (including phone numbers), the date of the last transaction and the amount. In one, easy-to-read chart I could see all of the places where I might have to reenter my card number, and I knew how to contact them to make a change. This was extremely convenient and helped with a key pain point of the conversion.

Reissue

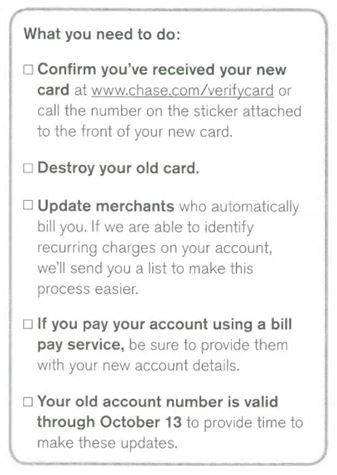

When the card is reissued, the best practice is to clearly tell the customer what is happening and what steps are needed to activate the card. It’s also a critical moment when issuers can explain what’s changing, reassure them of what’s staying the same and tell them about the new benefits (if any) that come with the new card. Here again, Chase did a number of things right.

When the card is reissued, the best practice is to clearly tell the customer what is happening and what steps are needed to activate the card. It’s also a critical moment when issuers can explain what’s changing, reassure them of what’s staying the same and tell them about the new benefits (if any) that come with the new card. Here again, Chase did a number of things right.

About a month after the pre-notifications, right when Chase said it would, my new card arrived. Enclosed in one envelope I found the following:

- a card carrier with personalized fields (my new account number and credit line) and clear instructions on what to do;

- an insert telling me how to use my new EMV Chip at point of sale (remember, we’re going to see more and more of those);

- a “Guide to Benefits” that I quickly scanned (because who reads all of those details) so I knew a little about the other benefits; and

- one sheet with a brief overview of what changed and what did not.

Everything was clear and easy to follow. In fact, after just a quick first look I knew some critical information including the number I had to call for activation, the fact that my new card had an EMV chip and that my old card would be deactivated on October 13.

Post-conversion

Even the best conversion programs will have some customers who do not respond or activate. But here, issuers have different options on what to do, and best practices are often dictated by a cardholder’s overall value. Everything from no action, to a simple follow-up, to an incentive offer could be on the table.

So far Chase had done several things very well with my conversion, but I decided to wait and see what they would do if I did not activate. About three weeks after getting the new plastic, I received another letter, similar to the pre-note. This one flagged the lone online charge made in the last month on the old card, had a stronger headline that lead with “ACTION REQUIRED” (compared to “UPDATE” in the pre-note) and acknowledged that the new card had been sent.

But in what feels like a missed opportunity for Chase, there was no copy saying that if I hadn’t already, I should activate right away (at that point, it was only days away from the October 13 deactivation deadline).

As of this writing, I have not received any further activation reminders from Chase. It’s possible that they don’t feel the need to remind me (full disclosure, this card is not “top of wallet” for me). It’s also possible that with a big effort like this they have limited capacity for post-conversion communications. But since they have my email address, know I opened my first email from them and know I haven’t activated my new card, it seems like it would be easy enough to send a generic reminder email encouraging me to activate (or call them if I had not received my new card).

Overall assessment

That last point aside, Chase did a great job with this conversion. They used two pre-notification touches to help me plan ahead and avoid online charges that would not go through once the old card was deactivated. And they sent a very thorough card carrier package with the new card. Other issuers should take note and follow this lead to help make future card conversions as seamless as possible.