Consumer Spending Habits: Insights for Merchants and Issuers

Javelin recently shared invaluable insights about consumer spending habits across three channels: in-store, online and mobile. It also provided recommendations for issuers and merchants on improving the frequency and value of payment methods used by consumers. Your payment strategy may well benefit from the review of findings available in these reports.

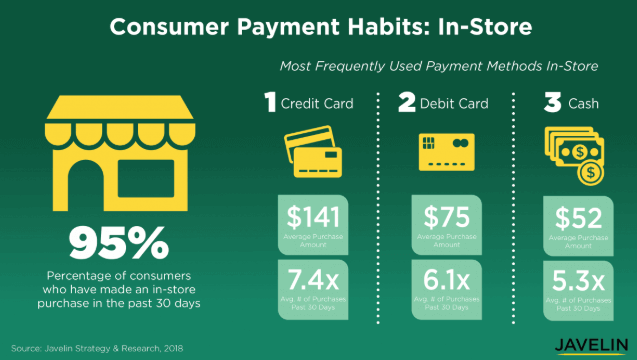

In-store spending habits

- Merchants have the greatest influence over the payment channel selected.

- Credit cards dominate, with debit in second place.

- Cash has fallen to third position – used less frequently – but Javelin believes “cash is not going away.”

- Consumers spend more money and are more open to being influenced in store when using credit cards.

- Cash is used for smaller purchases ($52 on average per transaction).

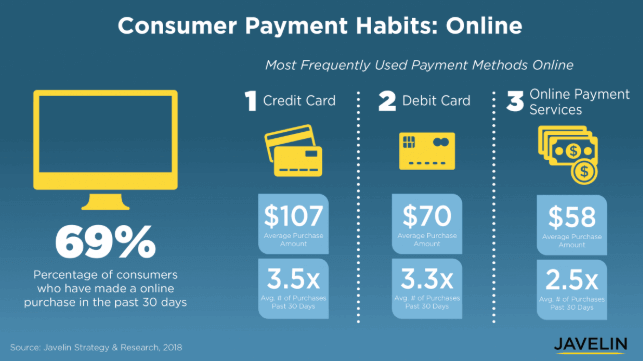

Online spending habits

- Browser-based e-commerce continues to grow with nearly 70% of consumers making monthly online purchases.

- “Click and collect,” which is an online purchase picked up in-store, is adding to growth.

- One in 15 consumers is impacted by a false decline which then influences the decision to switch payment choice, making more accurate experiences and reduction in false declines key areas of focus for merchants/issuers.

- Consumers who use third party payments (e.g., PayPal, Amazon Pay) have the lowest spending frequency, as well as the lowest dollar amount.

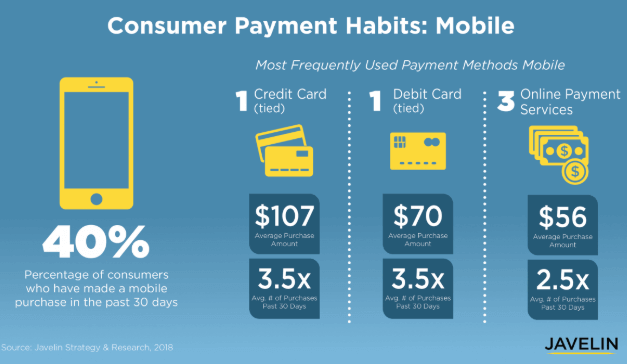

Mobile spending habits

- Consumers split their time between browser-based and mobile app payments.

- Mobile app payments are changing, and Javelin believes the category will require further definition as mobile payment options expand.

- Sixty percent of consumers have not used mobile payment to make a purchase. Addressing concerns about payment security and educating consumers about the benefits can change this behavior.

- Merchants are increasingly enabling consumers to add/load prepaid cards into mobile apps (e.g. gift cards at the holiday season can be loaded into mobile apps, increasing their rate of use and reducing past levels of breakage).

- Forty percent of consumers use mobile payments with stored value prepaid evolving into the top 3 position of payment.

- Frequency/volume of mobile payments is consistent with those of e-commerce browser payments.

What are the key takeaways that Javelin identifies based on these payment insights?

- In-store experiences associated with credit and debit card use can help create “immersive experiences.” Javelin suggests merchants/issuers look to after-hours access, personal shopping assistance, additional rewards, additional discounts and free gift wrapping (could be at the FI branch, too).

- To push debit use in-store, merchants and issuers can help consumers understand available debit spend especially to accommodate large purchases and provide dashboards and other management tools with the objective of reducing shopper anxiety at POS.

- To increase online payment behaviors, merchants and issuers should focus on strategies to increase card-on-file.

- Credit cards used for online purchases result in 33% more in average ticket value. When cardholders experience false declines and increasing fraud rates, merchants and issuers should ensure that consumers know debit is a secure alternative with consumer protections.

- Merchants should continue to enable consumers to add/load prepaid cards into mobile apps to facilitate their use for payment.

- Merchants and issuers should further educate consumers and promote mobile app payment. The goal should be to stress the benefit set, including security.

- In-store education – Javelin suggests “technology days” – can be used to demonstrate to customers how mobile payments work and to educate them regarding benefits.

Javelin sees moving from consumer perceived value to actual benefits as an important strategy when attempting to add and expand payment methods. We agree. As emphasized in a recent Media Logic blog post, the intense competition for payment options makes customer communication incredibly important for merchants and card issuers. The Javelin insights remind financial services marketers that usage campaigns must prioritize customer awareness/education and build consumer confidence at the point of sale, whether it occurs in-store, online or via mobile.

You can read the full reports on Javelin Strategy & Research blog here:

- How Consumers Pay – Consumer Payment Habits: In-Store

- How Consumers Pay – Consumer Payment Habits: Online

- How Consumers Pay – Consumer Payment Habits: Mobile

Header image sourced from rawpixel on Unsplash.