Can Rewards Sustain a Customer Relationship?

With recent news about Subway launching a new loyalty program with the hope of reversing falling sales, we could not help but ponder the question: can a loyalty program actually sustain a relationship?

Like much of life, reward programs are possibly best evaluated in the context of psychologist C.E. Rusbult’s theoretical framework, the “Investment Model of Commitment.” You might recall from college psych that the Commitment Model identifies four factors that impact the likelihood a relationship can go the long-haul: satisfaction, investment, quality of available alternatives and commitment.

Colloquy Loyalty Census reports 3.8 billion U.S. consumers are enrolled in loyalty programs (664 million within the financial services category). With that level of saturation, the continual launch of new credit card reward programs and the reinvention of existing programs, there is a high degree of churn and upward pressure on brands as an estimated 12% of consumers report they constantly switch programs in which they participate.

As a result, brands should focus on driving satisfaction and making wise investments through value-adds, while keeping a constant eye on competition in and out of category. And when it comes to financial services specifically – payment card rewards, retail bank relationship rewards and co-brand loyalty programs – following the most basic of best practices in marketing and communications will have positive outcomes.

First, continual customer communication is essential by building multiple touchpoints into your lifecycle plans across channels. Keep in mind that communications must also be relevant, as 59% of consumers polled by Colloquy report they ignore irrelevant communications from a loyalty program. The key to relevance relies on data and highly personalized offers that may be trigger- or behavioral-based.

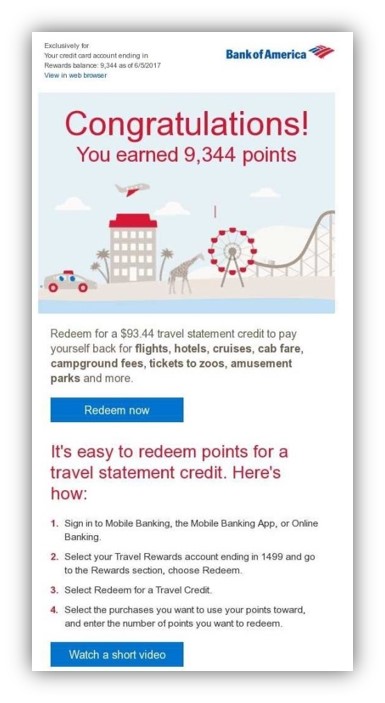

Second, pay attention to redemption activity. It’s the single most important signal of commitment and satisfaction. Prioritize loyalty communications that push redemption with timely reporting of rewards balance and near-rewards threshold redemption opportunities. As basic as this best practice may seem, Mintel Comperemedia recently observed that some brands emailed panelists about rewards only one or two times in all of 2017. Others are doing a better job. As seen in these sample emails* gathered by Mintel Comperemedia, top financial institutions are:

Using near-threshold or at-threshold timing to serve up offers.

Discounting an offer as a way to push redemption.

Bonusing the customer with accelerated rewards to spur activity.

Using seasonality to creatively and proactively highlight new ways to use rewards.

This summer email outreach from Bank of America promoted cash back redemption options suggesting end-uses like paying for campground fees, amusement parks and family activities.

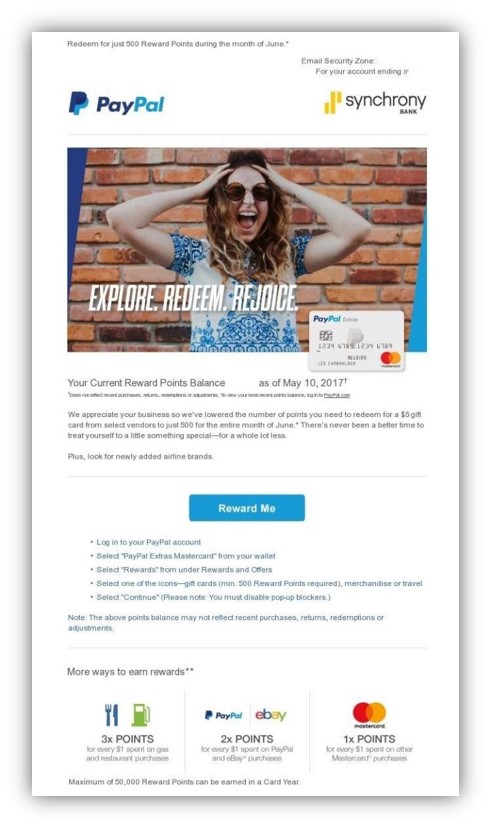

Promoting a “redemption sale” by lowering the usual threshold required for redemption.

Here, Synchrony Bank expresses appreciation to customers by lowering the points required for a gift card.

Breaking out of the expected, while side-stepping missed opportunities.

Fidelity is smart to use video to promote their Rewards Center. It is unexpected – as many of these samples are – and on-trend for coveted customer segments. Unfortunately, the video link gets lost in the clutter of the communication (it’s at the very bottom).

Facing up to and defending against the “quality of alternatives.”

Capital One understands the crowded travel category. The rise of attractive, buzz-worthy products like Chase Sapphire Reserve may have influenced Capital One’s 2017 promotion for VentureOne. This offer drives cardmembers to a new travel platform, offers a 5% discount on airfare redemption, provides rewards balance and adds an element of urgency through the use of a digital countdown within the personalized email.

Perhaps Colloquy says it best when it formulates “marching orders” for loyalty programs: deliver meaningful rewards and relevant rewards, in a frictionless manner, while making consumers feel known as individuals. Ease of use aside (table-stakes!), Colloquy identifies top motivators for participating in programs: the program is seen as going beyond expectations and recognizing love of the brand, company, retailer, service, etc.

Circling back to our opening question, we would have to answer, “Yes, we believe a rewards program has significant potential to sustain a relationship.” However, reality suggests many brands, along with their customers, are teetering on the edge of the committed/not-committed precipice.

* SOURCE: Mintel Comperemedia’s January 2018 report on “Newsletters & Rewards Balance Email Notifications from Financial Institutions.”