Tip Sheet: Essential Early Month on Book (EMOB) Strategies for Community Issuers

Tip Sheet: Essential Early Month on Book (EMOB) Strategies for Community Issuers

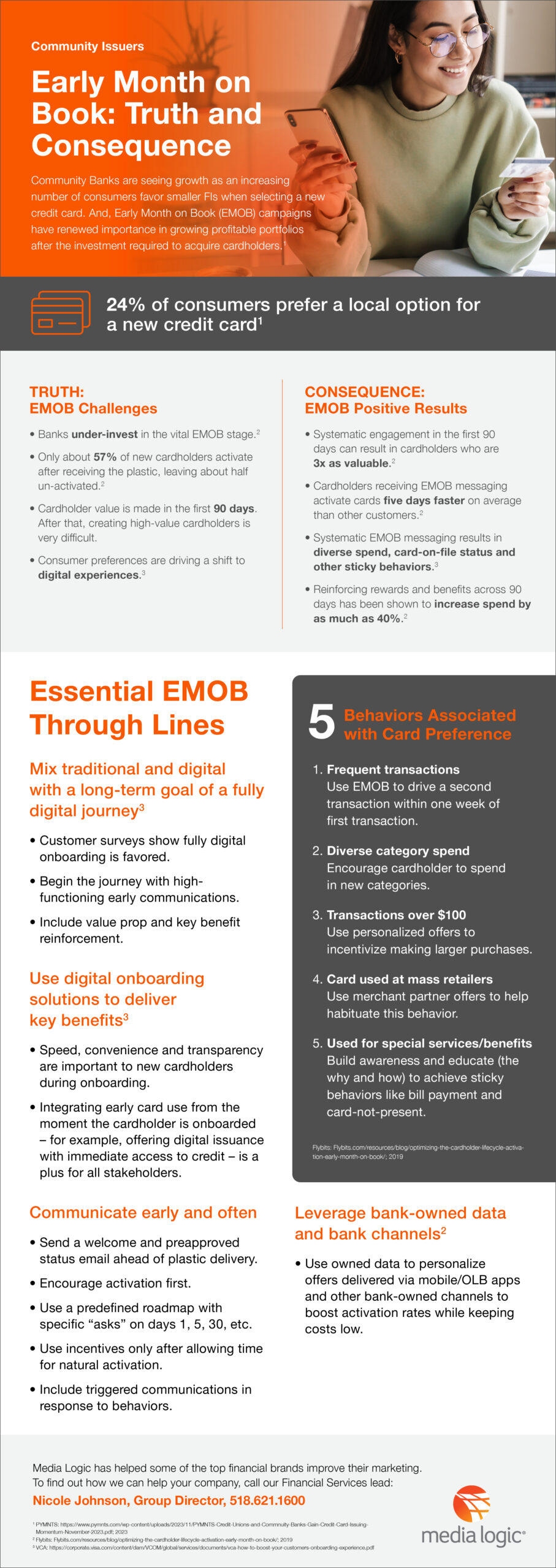

Community banks and credit unions (collectively referred to as “community issuers”) are gaining momentum in the credit card issuing space. As consumers increasingly favor local options for their financial needs, community issuers have a unique opportunity to capitalize on this trend. One critical strategy for maximizing the value of new cardholders is early month on book (EMOB) engagement.

Why EMOB Matters for Community Issuers

According to the PYMNTS Intelligence study, credit unions and community banks are seeing an increase in new credit card issuances. However, under-investment in the EMOB stage can lead to suboptimal activation rates, with only 57% of new cardholders activating their cards upon receipt. Conversely, issuers that deploy multi-channel communications for activation, with the goal of meeting customers’ changing channel preferences, are realizing an improvement of more than 300% in activations, according to a recent Visa best practices white paper. Systematic EMOB engagement can triple the value of cardholders, leading to increased activation rates, diverse spending behaviors and higher overall spend.

So, how can community issuers make the most of EMOB? Media Logic’s card marketing experts outlined the truths, consequences and best practices you should know. Click here to download the tips as a PDF.

Here are a few of the EMOB strategies for community issuers outlined in the tip sheet above.

1. Integrate Digital Onboarding Solutions

- Speed, convenience and transparency are paramount during onboarding. Offering digital issuance with immediate access to credit can enhance the onboarding experience and ensure early card use.

2. Mix Traditional and Digital Engagement

- While the long-term goal is a fully digital onboarding journey, a hybrid approach can be effective. High-functioning early communications should include a mix of traditional and digital methods.

- Begin with welcome and preapproved status emails ahead of plastic delivery, encouraging activation from day one.

3. Communicate Early, Often and With Personalization

- A predefined roadmap with specific engagement points (day 1, 5, 30, etc.) ensures consistent communication.

- Leverage bank-owned data to personalize offers and messages delivered via mobile apps and online banking channels.

4. Encourage Key Spending Behaviors

- Drive frequent transactions by prompting a second transaction within one week of the first.

- Encourage diverse category spend and larger purchases through personalized offers.

- Promote card usage at mass retailers and for special services, such as bill payments and card-not-present transactions, by building awareness and educating cardholders.

For more information for community issuers, check out our blog on how credit unions and community banks can compete with national players for credit card market share.

Note: This blog was originally published in July 2024 and updated in March 2025.