Q&A on Financial Services Marketing Opportunities With Female Super Consumers

The Media Logic Healthcare team recently shared a perspective on accurately engaging with seniors prompted by ABC’s The Golden Bachelor, which featured a 72-year-old bachelor and the senior women vying for his affection. The series earned accolades for its portrayal of older adults, and our colleagues’ blog post urged marketers to take its lessons to heart.

For us, the series and the blog post bring to mind another misunderstood and underrepresented segment: the female Super Consumer. We sat down with Media Logic’s Nicole Johnson, Group Director and Financial Services team lead, to discuss the female Super Consumer and related opportunities for financial institutions.

Describe the female Super Consumer and why financial services brands should ensure she is on their radar.

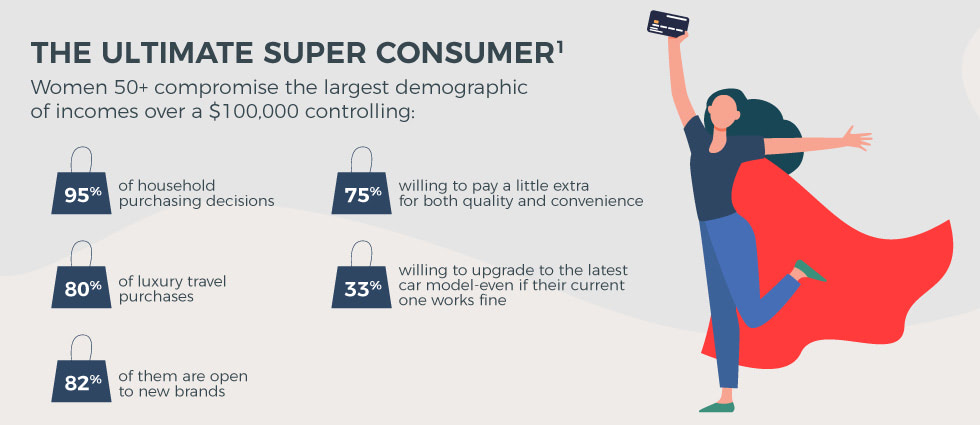

Nicole: Let’s start with Forbes’ high-level description of Super Consumers: a group of 40 million American women, age 50+, representing over $15 trillion in purchasing power. They account for 27% of all consumer spending. These women are the healthiest, wealthiest and most active generation in history. Their level of health, wealth and vitality is key to their ascendancy.

As noted by Forbes, these characteristics (combined with their level of income, spending and influence with one another) underscore their worth to brands. They are forecasted to account for “off-the-charts spending power” – 75% of discretionary spend by 2028, as they experience the largest population growth over the next 10 years.

I also want to call out a sub-segment within the female Super Consumer segment: Gen X women. They are caught between conflicting agendas as the generation of females who were raised to reflect the traditional female gender role and – and at the same time – to become independent, professional career women. That dual expectation is a high bar.

To further understand the Gen X female Super Consumer, consider they are also part of the “sandwich generation,” referring to how the cohort is caring for both children and aging parents.

Can you describe the characteristics that make the Super Consumer segment an opportunity for the financial services category?

Nicole: You have the opportunity to differentiate your FI by making female Super Consumers a priority because brands mostly ignore them, with few exceptions. The result is that they can feel invisible:

- 91% of Boomer females feel misunderstood and ignored by marketers, according to Girlpower Marketing.

- When financial brands speak to Boomer women, they often get it wrong. Currently, banks and issuers are targeting females, although these efforts tend to focus on female business owners and entrepreneurs.

- 50+ women (inclusive of Gen X females) are more likely to feel that older women are portrayed negatively, rather than positively, in advertising (21% versus 18%).

Harvard Business Review provides proof of a lack of marketing engagement: Only about 5-10% of marketing budgets are earmarked for 50+ consumers (including men).

Female Super Consumers are highly represented in the general population. Because of the segment size and efficiencies of scale, effectively marketing products that meet their needs – while successfully engaging with them – can pay off.

Given their age, accomplishments and life stage, female Super Consumers already have banking relationships – can you identify the opportunity further?

Nicole: Clearly, female Super Consumers, at their life stage, already have bank accounts, checking accounts, credit cards… but it would be an oversight to think they are not open to change. For example, Forbes reports that 82% of women 50+ will try a new brand, while 64% of Boomer-aged women have dropped brands they felt were ignoring them.

We recognize that being entrenched with a financial brand differs greatly from a relationship with a clothing retailer or cosmetics brand, but bank account and credit card “switch” campaigns proliferate among the general population because they work. There’s no doubt that tailored switch strategies will work with this open-minded segment. However, the product being promoted – and how it’s being promoted to the segment through positioning, messaging, channels – can’t be a mass market approach.

Gen X female Super Consumers have personal debt from student loans, mortgages and credit cards leading to their greatest concerns focused on retirement savings. Balancing their complicated lives with ways to conveniently and easily manage money is critical. This could be a combination of in-person services and, without a doubt, digitally delivered services and solutions.

What advice would you give FS category brands who want to pursue the female Super Consumer?

Nicole: Marketing directed at females is not a novel strategy, but the standards on how to market to women – positioning, benefit hierarchy and creative elements, like visuals and copy – have changed significantly.

Over our decades of experience with FS clients, brands have approached women as the “CFO of the family” – the person retrieving and sorting through the household mail, writing checks at the kitchen table and maintaining the family budget. But this “CFO” concept is dated.

Replace the old thinking with marketing that recognizes the female Super Consumer as an accomplished person, the CEO of her own life, someone who seeks premium experiences from travel to wellness to discretionary spend on goods and services and, yes, she may still operate as the financial center of the family.

Do you have any high-level advice for getting started with the segment?

Nicole: FS brands must continue their focus on opportunity segments ranging from Alphas to Gen Z and Millennials – but not to the exclusion of female Super Consumers.

Start by identifying and targeting the younger sub-segment of the female Super Consumer in campaigns via a test-and-learn approach. This sub-segment is adjacent to the oldest Gen Xers (44 – 59 years of age) and the oldest Millennials at 43. Be sure not to “lift and shift” an existing Millennial campaign. Customize it for the female Super Consumer to engage and not alienate.

Assuming a you have developed a product that is relevant to the segment and meets their needs, you are ready to proceed. Research and in-market validation are the winning formula:

- Conduct research to uncover insights, validate assumptions and product positioning, identify benefits with highest appeal and confirm the best way to speak to and visualize the audience.

- Align with the segment’s passions – travel, health and wellness, high-end brand partnerships, self-improvement.

- Consider tactics beyond the traditional approaches (explore use of over-50 influencers, for example) to build awareness and consideration via media where female Super Consumers spend time and consume content.

- Translate insights into new, custom campaigns.

- Take a test-and-learn approach – isolate and test variables in the real world to determine the best way to move forward as measured against KPIs.