Why are Financial Institutions Merging Facebook Pages?

If the old saying “three makes a trend” is true, then financial service companies may be on their way to making Facebook page consolidation the social marketing trend de jour.

To understand what I mean, you might need a bit of history. When brands started to set up Facebook pages, one very big question emerged: should a company have a single Facebook page or many different pages for different products, services or even different locations? In financial services, we saw a handful of brands build out Facebook pages for different card or banking products. The idea behind this approach was that the content would be specific to that one product and thus highly relevant for “Likers” (or “fans” as they were once known) of that page.

That’s good in theory, but it also assumes that when a company (or product) posts something to Facebook, only the people who “like” that page will see it and that all content will be seen by all Likers. Fast forward to today, and we know that is not the case. With the growth in Facebook advertising, we routinely see content from pages that we do not “like,” and brands are combating the ever expanding reality of Facebook Zero.

With multiple pages, brands also have to create more content and manage multiple social media personas and voices. Plus, there’s the possibility that product pages defuse interest from a brand’s main Facebook page (why would customers “like” a bank if they already “like” a product?). Suddenly, having multiple pages seems less beneficial.

But what can brands with multiple Facebook pages do? Luckily, Facebook has a process that allows companies with two or more similar Facebook pages to merge them. A brand can move the Likers from one Facebook page to another and then discontinue the page that was merged.

So which FIs are merging Facebook pages, and more importantly, what can others learn from their experience?

Chase

The “trend setter” (or at least the first one we noticed) was Chase. The bank had a very active Facebook page for its Chase Community Giving effort – an early (and also somewhat trendsetting) philanthropic social promotion. The Community Giving program, which ran from 2009 to 2012, received both praise and criticism when it ended. But putting the evaluation of its success aside, the promotion received a lot of attention and was widely popular.

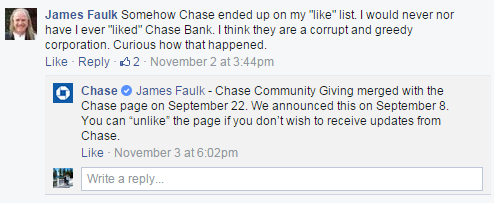

Chase left the page up for over a year, and in September of last year it decided to consolidate the Community Giving page into its Chase brand-level Facebook page. How do we know this? Someone asked about it.

Lesson learned: Merging pages may cause confusion. The Chase Community Giving page had a philanthropic angle, vs. being a “banking” page, and had been inactive for some time. When users who “liked” Community Giving found that they were suddenly a Liker of a page they never “liked” (or liked, as the case may be) confusion was bound to happen.

PNC

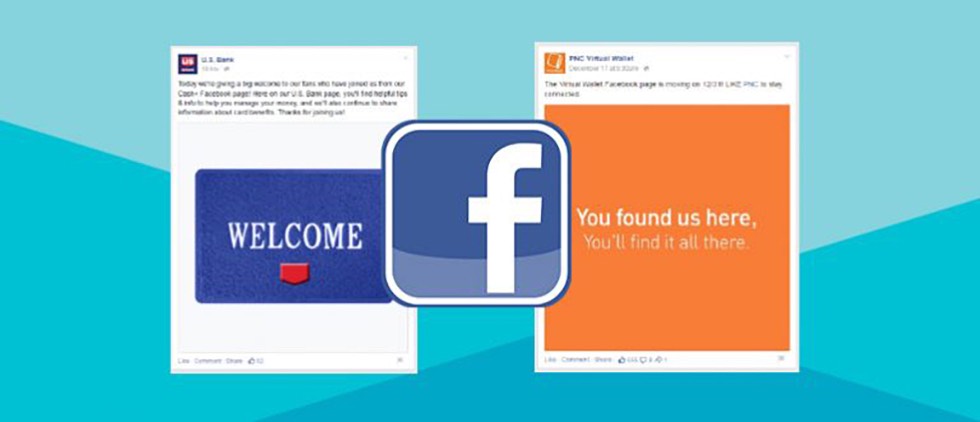

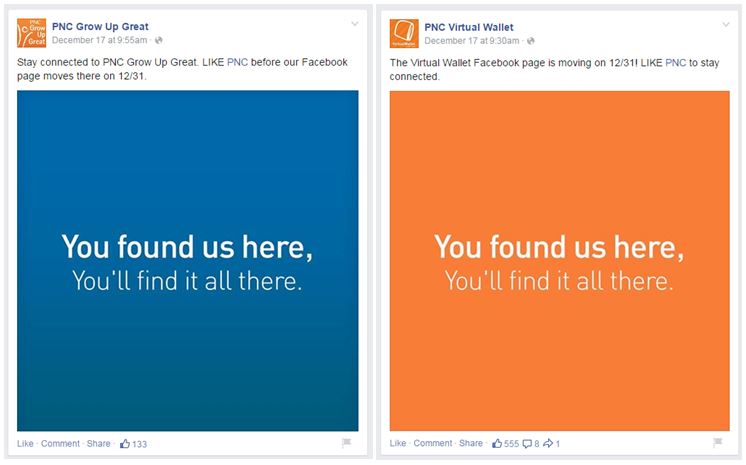

This major regional player had Facebook pages dedicated to its Virtual Wallet product and its educational grant program Grow Up Great. Last year, PNC made the decision to merge those two pages with the PNC brand page and communicated this to customers weeks in advance. It even invited Likers to make the switch on their own.

Lesson learned: Let customers know what’s happening BEFORE you merge pages and use it as an opportunity to get them to move over on their own. Bonus points to PNC for using a short, on brand and conversational approach that works well in social media.

U.S. Bank

Two of the bank’s popular credit products, FlexPerks and Cash+, were both launched in the era of social media. Both had distinct value propositions, and for a while, they both had an active presence on Facebook. However, earlier this year, U.S. Bank merged the pages with the U.S. Bank brand page. After the process was completed, U.S. Bank rolled out the welcome mat.

Lesson learned: Once the deed is done, welcome the new Likers into the fold. Even if you gave advanced warning (which U.S. Bank also did), some customers will have missed the memo, so a post notifying them about the change on the new (to them) page will help assure customers this was intentional.

What’s our take?

It’s unclear how much of a trend this will be in the end. Every bank has its own social media strategy, and for some, multiple pages may be the right choice. Indeed, Chase still has active product pages for Sapphire and Freedom (but inactive ones for Slate and Blueprint). And with its dedicated page for Ink, Chase is one of several brands with social streams specifically for small business products.

Pages that speak to distinct audiences, like small business owners or affluent segments, seem to have more utility than the ones that are solely product specific. With increased targeting, brands can more easily find their own customers on Facebook, so the dedicated product page seems to have less value now than it did four to five years ago. But for different audience segments (like consumer vs. small business), the overall content focus is very different, so the different pages have more of a reason to be.

Bottom line: if you do plan to merge pages, let your customers know it’s coming, tell them once it’s done, and be ready to answer their questions.