Navigating the Future of Co-brand Credit Cards: Trends and Challenges

2024 marked a noticeable decline in new credit card launches compared to previous years. Since 2021, the number of new products launched has declined, with the most significant drop occurring in the last two years, according to Competiscan. However, the co-brand credit card category experienced growth with the introduction of net new cards and new tiered versions of existing co-brands.

In the general-purpose card category, co-brands have also undergone refreshes—introducing new names, new bonus reward categories, enhanced travel protections, and new online tools to meet emerging needs. They’ve also added new airport lounge brands, or, in some instances, taken away benefits while lowering annual fees. In its 2025 Trends and Predictions report, Competiscan highlights that the payment landscape is “inevitably a dynamic one that requires both evolving to consumers’ needs and adjusting with the economy, and 2025 will be no different.”

Established co-brand partnerships have been renewed or evolved to consolidate card portfolios previously split between issuers. In December, well into 37 years as partners, American Airlines (AA) and Citi announced a full consolidation moving all AA cards to Citi in their new ten-year deal. A press release noted AA’s intention “to take this relationship to greater heights,” anointing Citi as the exclusive issuer. By 2026, AA CEO Robert Isom anticipates that the “expanded partnership will unlock even more value and exciting new benefits,” marking the first alignment between Citi ThankYou rewards and AAdvantage® card programs.

A Troubled Travel/Airline Sector

But not all is well with co-brands as the New York Times recently highlighted growing dissatisfaction among cardmembers carrying airline and travel cards, reporting many are “fed-up with the limitations and disappointments” of loyalty programs and their associated cards.

In 2024, marketing for airline co-brands accounted for an estimated 70% of the total volume in the travel co-brand space. Much of the marketing rationalizes high annual fees as trade-off for enriched value propositions and accelerated loyalty status.

These could be interesting times, especially considering the responses given when the NYT asked readers how they felt about their loyalty programs. Many responded that “they are done chasing airline status,” with some considering cancelling their airline credit cards. Many expressed disappointment after years of earning points and miles, only to find the currency “significantly devalued” as airlines changed their programs.

Despite recent consumer dissatisfaction, American Express reports, “strong retention and engagement levels in the Delta co-brand card portfolio.”

United also reports its MileagePlus program is growing at a record pace. The company recently announced new rules requiring passengers to fly more and spend more to earn status. It remains to be seen how those changes will impact United’s MileagePlus program. In contrast, AA maintained the thresholds for earning status as in previous years, distancing itself from the dissatisfaction other brands are feeling.

Growth Despite Sentiments

As 2025 unfolds, co-brand cards appear to be on track for growth. According to PaymentsJournal, the category is being positively impacted by higher credit scores which have led to an increase in card approvals, and a surge in travel. This increase in travel is driving transactions through lucrative rewards.

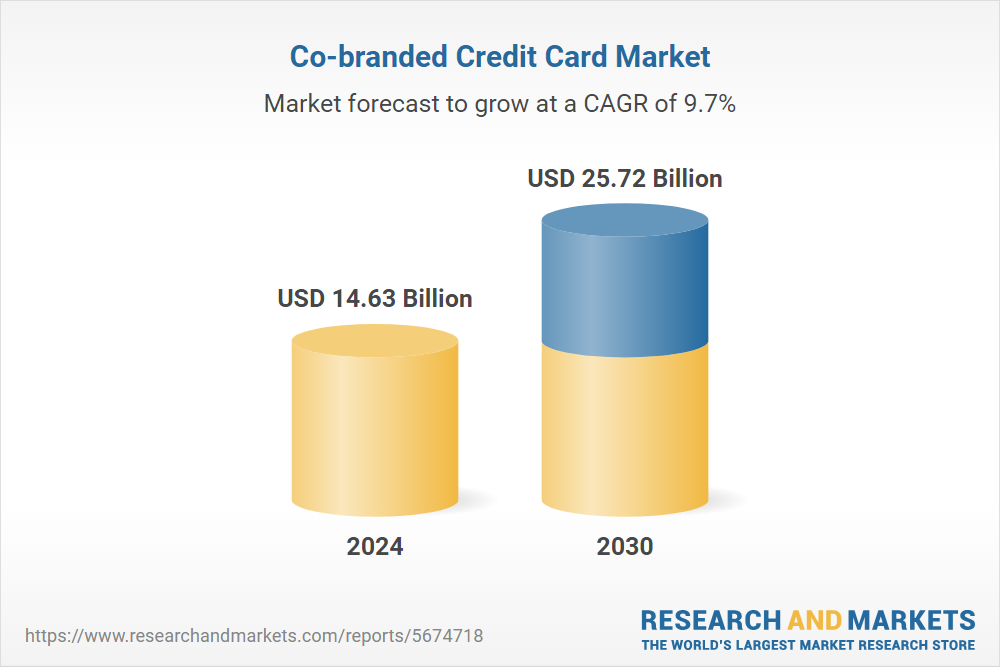

A recent Research and Markets Co-branded Credit Card Market report, predicts growth over the next six years will look like this:

A survey by YouGov that explored the appeal of co-branded credit cards in the U.S. found that only about one-fourth of U.S. consumers have a co-brand credit card, compared to 69% who have a general-purpose card, pointing to the opportunity for growth. To increase U.S. penetration and put co-brand cards in wallets, financial institutions can target specific opportunity segments that are defined by income and age and are currently under-represented in co-brand card ownership. Success in this endeavor requires developing and marketing of appropriate co-brand products with carefully calibrated value propositions, features and benefits, including welcome bonuses, all with appropriate annual fees.

Target prospects by age and income to reach those less likely to currently carry a co-brand card:

- 35% of individuals earning $80,000 or more have a co-brand card

- 25% of those earning between $40,000 and $79,999 have one.

- 15% of consumers earning less than $40,000 have a co-brand card.

Further refine targeting using age breakouts to identify opportunity segments, such as Gen Z:

- 16% of people ages 18-34 have a co-brand card.

- 25% of ages 35-54 have one.

- 29% of ages 55 and older have a co-brand card.

According to the survey, across the entire category, “Retail cards” (often referred to as private label cards) rank as the most popular type of co-brand card, with 55% of card users owning one, including lower-income consumers (40%).

Travel co-brand cards are more common among higher-income individuals, with 55% of those earning over $80k owning one, compared to 13% of individuals earning under $40k.

Technology-affiliated cards are popular with younger adults, with 40% of those aged 18-34 owning one. These cards remain less common overall (20%).

There’s also a strong business case for issuers and partners: Co-brand cardholders tend to manage debt better than the general population. The survey reveals about 43% of co-branded cardholders report paying off their full balance each month, compared to 31% of general-purpose and retail cardholders.

Moving forward

Keep the current regulatory environment—one of scrutiny—on your radar. There’s a well-publicized focus on the value of airline rewards, specifically the sale of points/miles by issuers to airlines versus the redemption value co-brands extend to cardholders. Widespread changes – from the need to update new legal disclosures to much more significant changes impacting loyalty program designs—are expected to impact several co-brand products.

There will be increased expectations for hyper-personalization as applied to communications, rewards, welcome offers, ongoing usage offers, and premium experiences. Winning co-brand partnerships will require leveraging available data and AI to engage both prospects and cardmembers.

Expect more co-brands to partner with fintechs as the shortest path to innovation in product development while catering to tech-savvy consumers.

Buy Now, Pay Later (BNPL) will impact traditional co-brand cards. The influence of BNPL on retail co-brand cards is likely to drive further innovation, with hybrid models and dynamic payment terms tailored to the type or size of transaction. Competiscan suggests that BNPL providers may offer their own rewards programs in the future. This competitive intrusion will trigger a flurry of co-brand card enhancements—greater rewards, more valuable perks, and incentives to choose BNPL programs attached to cards. In fact, Competiscan observes “This convergence between BNPL and retail credit cards is set to redefine customer loyalty programs and reshape the retail financing.”

Closing thoughts: The future of co-brands holds both opportunities and challenges along the anticipated growth trajectory. It’s crucial to retain best practices that are tried and true. Co-brands must consistently focus on encouraging everyday spend and maintaining constant top-of-wallet strategies and tactics. Adapting to digital payment trends and providing best-in-class mobile banking apps is essential, as dissatisfaction with these features often drives consumers to switch financial institutions. Strong and consistent cardmember onboarding should not be ignored—it requires time, resources and budget but pays off in terms of lifetime value. Personalization of offers—from welcome bonuses to “spend and get” promotions, and from incentives driving new behaviors to one-on-one trigger-based communications, is key.

Face and embrace the nature of the co-brand credit card market:

“The nature of the co-branded credit card market is dynamic, characterized by continuous innovation and high competition.”

Source: Co-branded Credit Card Market Trends and Industry Forecast, 2025-2030