How the JPMorgan Chase Branch Strategy Delivers for its Bottom Line

It’s not uncommon to hear about the demise of the bank branch, but even though the overall trend is toward branch closures, that doesn’t tell the whole story. Consumer surveys reveal that bank and credit union customers assign real value to branches, and industry experts point to opportunities that exist in reimagining physical branches.

Some banks have figured this out, most notably JPMorgan Chase (JPMC). To see what sets the JPMC approach apart from the rest – and glean lessons for other bank and credit union marketers – our team takes a look at the bank’s branch strategy and its very positive ROI.

Why Banks Are Closing Branches

It’s been 14 years since the overall number of U.S. physical bank branch locations increased. At that time, bank branches numbered around 100,000. Today, there are fewer than 80,000 bank branches. What are the top drivers of these diminishing branch numbers? According to American Banker, in recent years

- Mergers and acquisitions have proliferated.

- Social distancing shut down branch traffic for a while and increased use of digital products and services.

- Closing branches became a cost-cutting measure with the opportunity to divert funds to digital channels.

Reimagining the Bank Branch

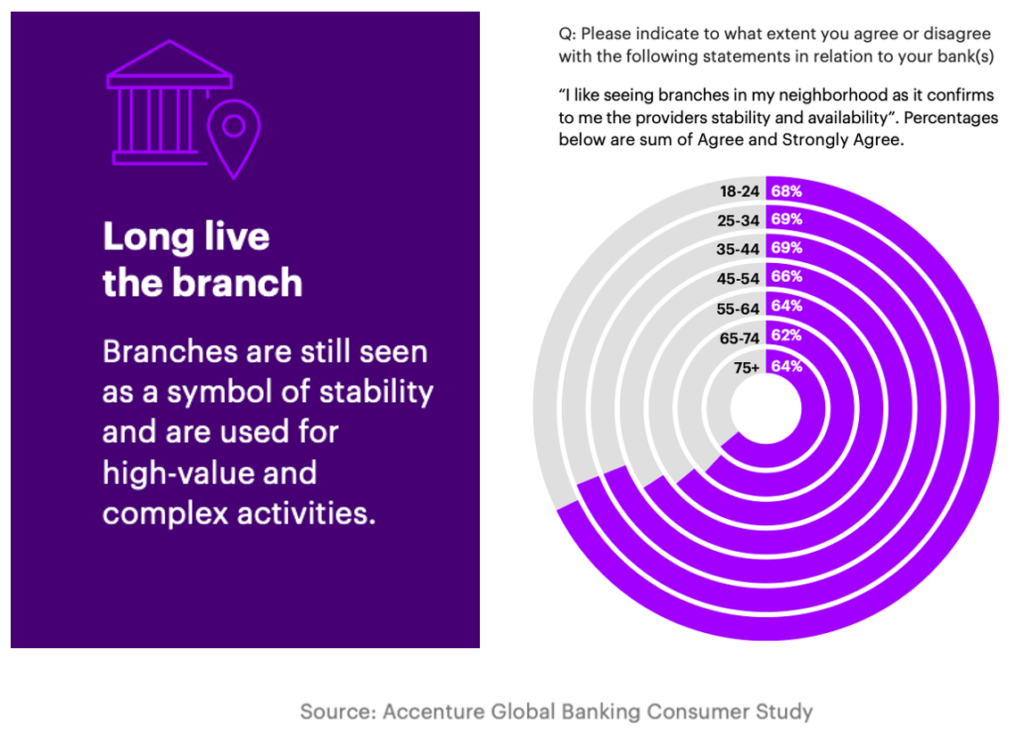

Despite the trend, banks may want to consider Accenture’s 2022 survey insights on consumer sentiments and attitudes about branches. High-level findings suggest there is value to maintaining a branch infrastructure. For example, just 3% of consumer interactions with banks happen face-to-face, yet Accenture data shows consumers still value the branch:

- 67% like seeing branches in their neighborhood, as it shows the stability and availability of their bank. (Consumers across all age groups feel this way.)

- Consumers still rely on branches for specific but important transactions. Over the past 12 months they used branches more than any other channel to open accounts, get advice and acquire new products.

- 63% turn to branches to solve specific and complicated problems.

Since customers still value branch interactions, many banks are changing the physical format of their branches – instead of closing. They’re adding self-service technology and creating a less traditional branch layout. But this level of reimagining the branch must go deeper.

As shared in a previous post on the strategic role for bank branches, FIs are encouraged to look to other industries — like hospitality and healthcare — for inspiration. When it comes to envisioning innovative branches, Ipsos advises, “Banks can learn much from the hospitality industry by using a highly segmented strategy to create distinct branch designs and layouts (all while maintaining a single bank brand) focused intentionally and exclusively on creating unique experiences for specific customer types and branch usage occasions.”

JPMorgan Chase Bucks the Branch Closures Trend

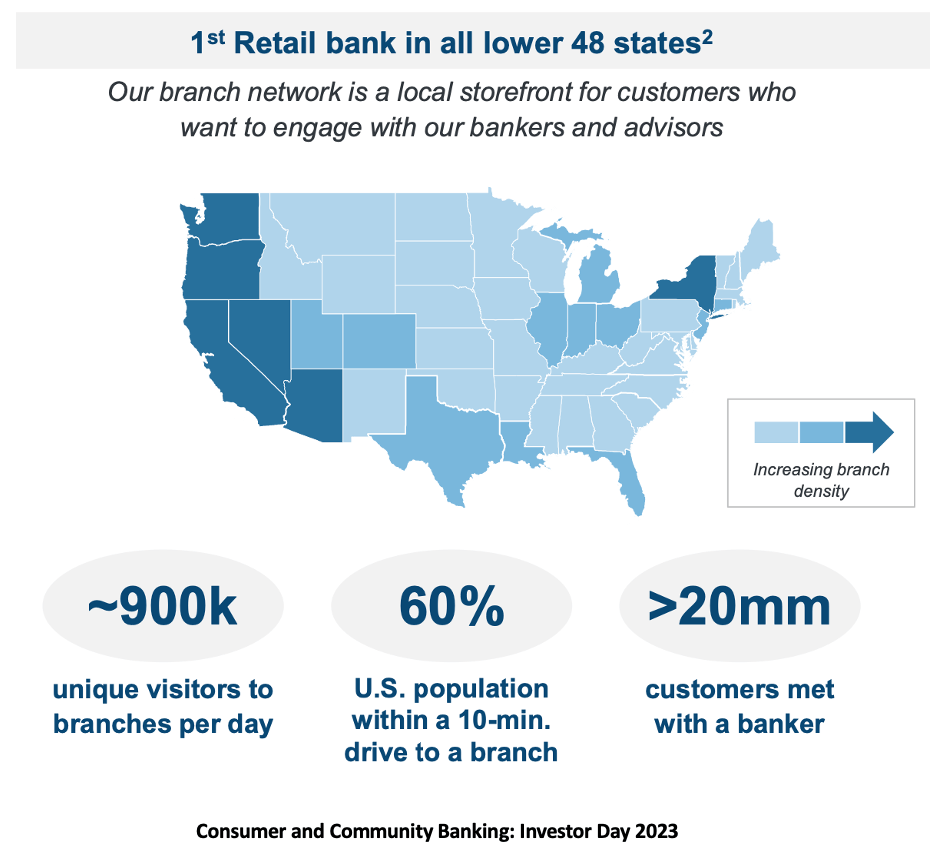

While JPMC has decreased their brick-and-mortar presence in the past, it has been to a lesser extent than their peers, including Bank of America, U.S. Bank and Wells Fargo Bank. It’s impressive that JPMC has not only reimagined the franchise – to become the #1 bank presence in the lower 48 U.S. states – while also expertly using its branch strategy to meet business goals. The key to this success? Alignment with customer needs and preferences.

The JPMC 2023 Investor Relations Day presentation captures the brand’s impressive results, including increased daily branch visits, branch density and customer/banker interactions.

What are the JPMC branch network goals and how is it doing? According to the JPMC report:

- Growing deposit share. JPMC achieved #1 deposit share in the top 11 of their 50 markets.

- Creating more engaged relationships. JPMC says more than 75% of balances are held by regular branch visitors.

- Driving deeper relationships. JPMC reports about 20% productivity increase by bankers (compared to a 2019 benchmark) suggesting improved, relevant interactions are taking place in-branch. In addition, a related, strategic goal is to optimize and extend the JPMC branch network to reach and gain trust in more local communities.

We’ve also observed that JPMC uses its branches as a selective and strategic marketing channel for specific products. For example, in June 2023, the brand launched Chase Freedom Rise, a new credit card targeting new-to-credit and thin credit file consumers. JPMC drove prospects directly to the branch as the only place way to get an application. This strategy relies heavily on the branch experience to convert prospects to cardholders.

Chase is targeting more than 25M U.S. consumers with this offer for Chase Freedom Rise credit card: “Whether you’re a student or are establishing credit later on in life, this credit builder card is for those with limited or no credit history. As of the card’s launch, the Chase Freedom Rise℠ can only be obtained by physically going to a Chase branch and filling out an application there. The card requires depositing $250 into Chase checking account to be approved. Our bankers are on standby in your local Chase branch to answer your questions and help you with your application. Let’s get started on your financial future.”

Where the JPMorgan Chase Branch Strategy Gets It Right

Thinking about “reimagine the branch” advice from Ipsos, we revisited three of the Ipsos recommendations to see how the JPMC branch strategy compares. As you can see, Chase checks all the boxes.

1. Segmented Strategy

JPMC is committed to distinct segments, as well of lines of business across customer segments, using the branch franchise. Specifically, JPMC’s strategy targets the mass market segment (including “emerging markets” and the mass affluent segments), the business segment and the affluent segment. How’s it doing?

- JPMC uses the branch successfully to originate new business checking accounts for SBOs.

- In early 2023, Chase announced their plan to hire 500 Small Business Bankers over the next two years which speaks to both a brick-and-mortar expansion and increased demands for expertise.

- JPMC reports that approximately 25% of branded credit cards are sourced at the branch level.

- JPMC Wealth Management is growing its affluent consumer base, with more than 85% of first-time investors originating from banker referrals.

2. Distinctive Branch Design and Layout

Contemporary branch design is table-stakes amongst banks. Most new and refurbished branches rely on niche architectural design firms with category experience, making this more universally achievable for all types and sizes of FIs. But is that enough?

JPMC’s “Community Center” concept looks and feels different from the expected. Yes, it includes contemporary design, spacious layout and banking technology, but there’s more. As noted in a local media report on Jamie Dimon visiting a branch in Philadelphia, “the Chase Community Branch [also] has classes on financial literacy and how to run a small business. … The bank offers free WiFi and a multipurpose room for community events.”

3. Unique Experiences

To further deliver on the segmentation strategy, the JPMC in-branch experience is customized and unique to customer needs and expectations by location. For example,

- As seen in Philadelphia, Community Centers that serve emerging markets focus on building trust and local financial help by offering financial health events, dozens of workshops and free community space.

- In locations serving mass affluent clients, Chase offers “Personal Advisors” poised to help this segment with “low-cost advice” (different from the expertise and deep offerings of the HNW Private Client experience).

- In HNW/premium markets, JPMC leverages the recently acquired First Republic Private Wealth Management branches with high-touch services adding “scale to the office-based model.”

Results: The JPMorgan Chase branch strategy is Working

JPMC acknowledges the investment in branch infrastructure and staffing represents a long-term payout. Using 2019 benchmarks for comparison, JPMC has shared data indicating very positive results in revenue and engagement attributed to branch effectiveness.

- Increased consumer and small business customers by about 30% (2019 to 2022)

- About $85B in deposit growth from branches (since 2017)

- A 4-year break-even on Chase new builds

- About $160B in incremental deposits

As you might expect, JPMC is equally focused on digital delivery. This dual focus delivers a best-in-class offering whereby Chase serves customers anytime, anywhere, in the channel of their choice. According to JPMC data gathered for investors, JPMC has the #1 digital banking platform. Specifically,

- 63MM+ active digital customers

- over 15B digital logins

- more than 20 mobile log-ins per month (customer average)

What Banks and Credit Unions Can Learn From the JPMorgan Chase Branch Strategy?

FIs typically invest in some level of refreshed branch space with increased technology and self-serve options. That may be all that is possible for many brands who struggle with implementing branch strategies due to the challenges of collaborating with multiple stakeholders.

However, there are ways to implement programs – emulating JPMC strategy and tactics – that can be powerful and achievable at smaller scale. Here are some of those opportunities:

Focus on Segmentation

Of all the branch strategy and tactics discussed, segmentation appears to have the highest impact, as clearly Chase sees great results. To that end, all brands can apply some level of segmentation at the branch level:

- Turn key locations into “centers of excellence” for your brand’s priority segments.

- Deploy branch-wide training and incentive programs to facilitate segmentation-based selling. Media Logic has implemented many successful “add water and stir” programs at the branch level – low lift, big results, segment-focused.

- Address the missing link: marketing. It’s necessary to promote the branch to priority segments continuously, including iterative communications.

Create In-Branch Experiences

Human interactions deepen engagement. Driving customers to the branch for specific products and high-touch needs should be part of the branch strategy. Specifically,

- Make it easy for any customer to proactively set up a personal meeting.

- Use direct mail to offer a personal “coffee and chat” sessions that include an in-person product incentive.

- Tap qualified local resources to address and educate customer segments at branch-hosted events and follow up with attendees to offer in-person banker meetings.

Tap Digital to Promote Branches

Use your brand’s digital channels, including your website, to support and elevate the branch. Dedicate webpages to branch information like staff bios, an image gallery, upcoming/past event promotion/calendar and testimonials. It is critical to use digital channels to build awareness and drive traffic to physical branches.

Meet the Customer Where They Are

Finally, emulate JPMC’s path to serving customers anytime, anywhere, in the channel of their choice – and be sure they’re aware of the valuable branch interactions you can offer.

*

The bank icon used in the featured image for this post is from HAJICON on Freepik.