Marketing to SBOs: Insights from the Bank of America Report

Bank of America Corporation (BAC), a financial institution with a high degree of focus on products and services for small business owners (SBOs), has regularly updated and shared insights culled from its proprietary survey of business owners across the U.S.

BAC has published the Spring 2014 report, and for those interested in better understanding – and effectively marketing to – the SBO segment, it is worth reading and considering.

Some of the key takeaways:

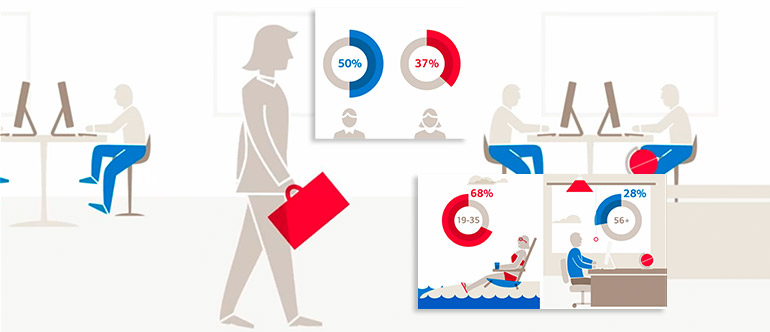

- Small business growth is shifting from male to female.

- Women – the growth segment – are more optimistic than men but still share the same concerns about the rising costs of healthcare, interest rates and the strength of the USD.

- Those seeking loans are doing so to invest in their businesses – upgrades, expansions and new equipment.

- SBOs are confident their local economies will improve over the next year.

- Women consider their ability to multi-task to be their strongest trait, followed by creativity, confidence and empathy for employees. (Men cite multi-tasking as their strongest trait, with confidence a close second.)

- Women are more effectively juggling work/life balance.

- Across the board, SBOs feel they have sacrificed their personal lives significantly for business – including time for self, vacation and leisure and general social life.

- About one-third of women feel they have less access than male SBOs to capital and new business opportunities.

- The rate of loan applications is down (although approvals are up). 54% of SBOs say they are well funded, 42% want to avoid debt and 23% will use personal funds if needed.

Some implications for marketing to SBOs based on the BAC insights:

- Now, more than ever, SBO marketing collateral should equally represent both male and female segments:

- Use messaging that is neutral or, at the very least, inclusive of both genders.

- Use imagery that represents and appeals to both genders.

- If your product or service is targeting start-ups and new small business, be sure to consider that SBO growth is being fueled by women. This means your materials should resonate with the female segment.

- Just as Bank of America demonstrates via its social streams and its small business community, offering customized programs for female business owners – including career development, education and networking opportunities – will establish you as a “go to” resource for this growth sector.

- For discreet business products and services, it may be less efficient but more effective to target women SBOs with marketing materials that reflect the insights from this study. Create materials with the knowledge of how females and male counterparts think and act differently.

- Making the case for “separating personal from business” is still appropriate given that almost one quarter of the survey participants would turn to personal funding rather than loans even though they are readily available with a high rate of approval.

- Overall, your products and service will benefit from promoting the ability to save the business owner time. This continues to be important, as the survey proves.

- SBOs have confidence in the local economy, and you can take advantage of this outlook by speaking as a local resource with key impact on your community.