Marketing Mobile Banking Apps and Debit Cards for Young Consumers

Over the past five years, there has been a flurry of new mobile banking apps and linked debit cards designed for the youngest consumers. Banks, credit unions and fintechs are targeting youngsters up to 17 years of age by way of a connected parent. The lowest eligibility requirement for an account we have seen is six years of age.

Finding in-market samples for these account products is difficult. The campaigns are underrepresented by services capturing marketing – most likely due to relatively smaller campaign size and the dominance of digital channels. However, we can look to Chase as a brand that demonstrates best practices in acquisition efforts aimed at Chase First Banking customers.

A look behind explosive category growth

In addition to financial services marketing in general focusing on the needs of younger cohorts (notably Generations Z and Alpha), research supports three key factors explaining why these youth banking accounts have gained traction.

1. Customer loyalty

It is well-established that consumers are loyal to their first credit cards. Whether a result of loyalty or inertia, this bond extends to checking accounts and is likely the impetus for brands to establish banking relationships as early as possible.

Current research indicates that, on average, consumers use the same checking account for 17 years. The Financial Brand explains the reasons consumers give for their loyalty:

- 17% say it’s the “account I have always had.”

- 10% say it’s “too much hassle to switch.”

- 25% say they are loyal because of low or no monthly fees.

2. Appetite for financial literacy

Younger cohorts have a genuine interest in money and finances. In fact, we found it interesting that Copper Financial – a fintech partnering with Evolve Bank and Trust – has grown to at least 1M Copper Banking youth accounts by sticking to their belief in an age “sweet spot.”

Long known as an awkward age, 15 is now a magic number. Copper Financial Co-founder and CEO Eddie Behringer tells PYMNTS, “What we found is that every 15-year-old in America is looking for a product. They’re looking for their first primary bank account. Noting that this personal banking inflection point is now happening two to three years earlier than ever before, Copper is built on the idea that 15 is the ideal age to learn financial literacy.”

The surge of “finfluencers” who share financial education and appeal to young social media users seems to confirm this. For example, FinTok – or Financial TikTok – is a large sub-community of TikTok users who publish or consume advice and education about personal finance. Elinext reports, “Videos tagged #PersonalFinance garner more than 7.7 billion views, making it clear that teens and kids are interested in money-related topics.”

3. Fintech offerings

Fintech activity has fueled category growth with the proliferation of 89 products targeting teens/adults via $500M in investor funding, according to Crunchbase. Many of these fintech youth mobile apps are highly-rated and may also attract and convert parents to a fintech banking product for adults – a win-win.

Best practice marketing for youth accounts

A look at marketing for a youth account product from Chase reveals best practices for this category. Chase First Banking is designed for youth from six to 17 years of age. The product, introduced in 2020, features an app developed by Chase in partnership with Greenlight Technology.

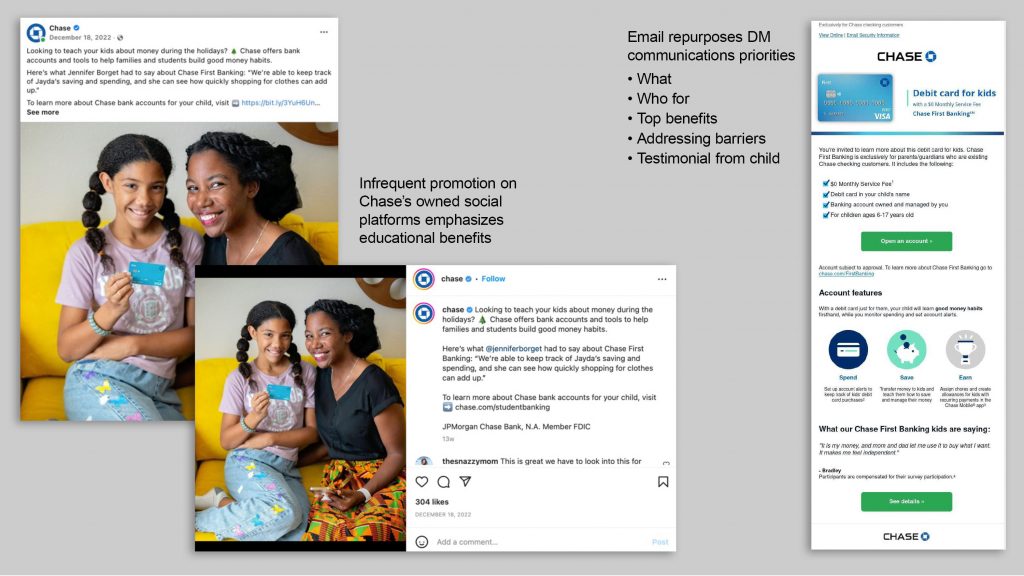

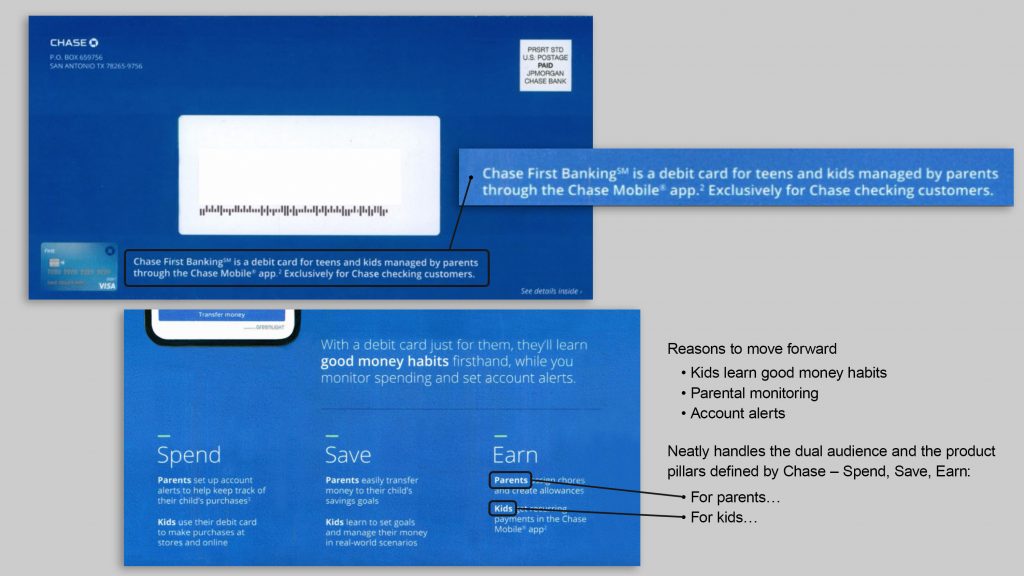

Chase set out to capture youth through their parents by mining their customer DDA base, restricting the product to existing checking account customers or those who will open an eligible account (any of five checking accounts). Since they are targeting existing checking account customers, Chase uses direct marketing channels, including direct mail and email, with minimal promotion seen on social media. And even though we did not observe digital marketing, it is likely part of the omnichannel approach expected from Chase.

Clearly, Chase aims to migrate First Banking customers to the next level account (Chase High School Checking) and beyond as they become customers for life.

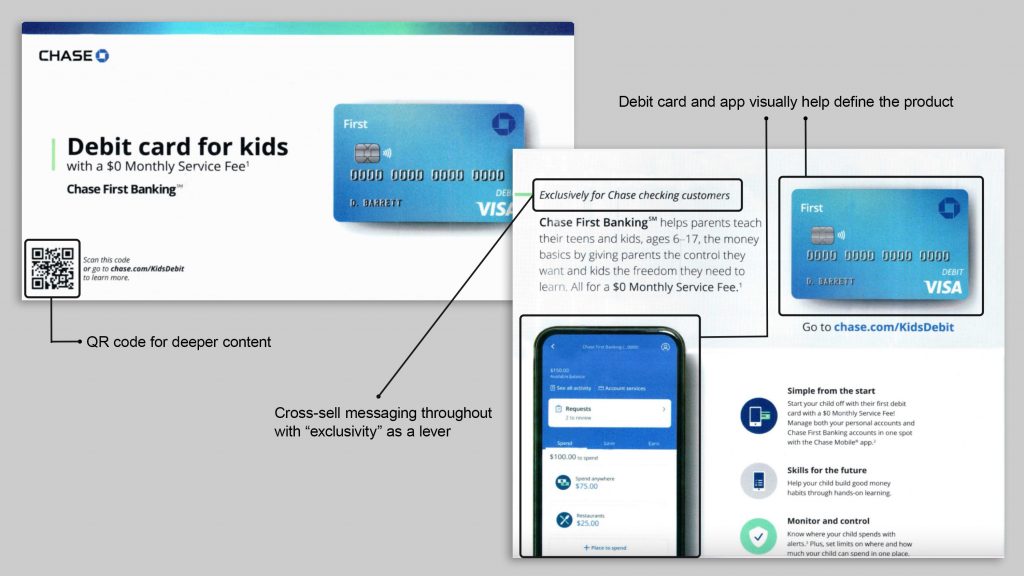

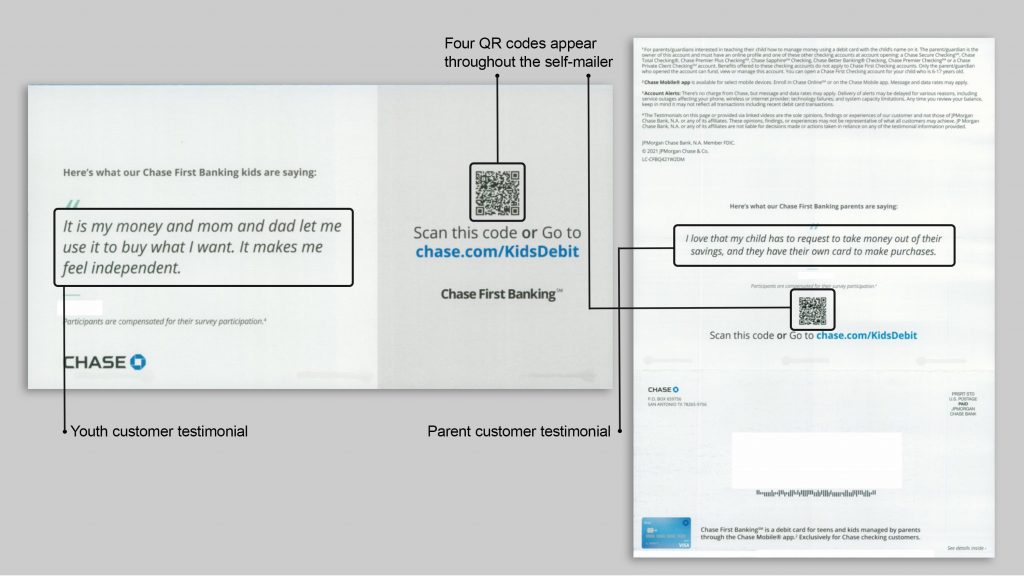

The 2023 acquisition marketing demonstrates a set of “best practices” for other brands to follow. In marketing Chase First Banking, Chase does the following:

- It quickly defines the product (a debit card for kids).

- It supports the product with visuals of the card and app.

- It engages the parent decision-maker.

- It focuses on benefits to youth while understanding that benefits must also motivate the parent.

- It proactively addresses and removes potential barriers by emphasizing control, security and $0 fees.

- Unique to Chase, it reiterates a cross-sell message (offer only for Chase checking customers).

- It offsets deeper content via QR code – product videos, Q&A and how to open.

- It features both parent and child testimonials.

The following images, sourced from Mintel Comperemedia (January-March 2023), showcase the best practices noted above.

In addition, as shown in these images from Mintel Comperemedia (January-March 2023), we also see that Chase uses email marketing and social media marketing to supplement direct mail.