Venmo, Chime and the Adulting of Millennial Financial Apps

The financial services industry has seen a long line of “disruptors” emerge in the last decade. Often created by and for the Millennial market, these app-based payment and banking brands seek to simplify and streamline “traditional” banking products. But these Millennial financial apps and companies are not only providing alternatives for a generation that doesn’t really trust big banks… they’re also figuring out how to evolve with the changing needs of their loyal users.

Venmo’s debit card extends virtual payments into the real world

One of the earliest, Venmo, is about to turn 10 years old. When it launched in 2009, Venmo’s founders were in their mid-twenties, which puts them in the “older” half of their generation. They created an easy way for individuals to use smart phones (also fairly new) to send money to one another. It quickly became so ubiquitous among its core audience that the name turned into a verb, i.e. “Venmo me the $20 you owe me.”

Of course, peer-to-peer payments were not new; PayPal (which eventually acquired Venmo) had a 10-year head start in the online personal money transfer business. But Venmo’s simplicity and social features made it the go-to virtual currency app for Millennials, and it has been able to retain a loyal base, despite many new competitors.

Now, that user base is 10 years older. Teenagers and 20-somethings who started using the app in the 2010s are now in their 20s and 30s. And guess what? Their favorite app is growing up. Late last year, Venmo added a radically old-school and very physical product – a debit card.

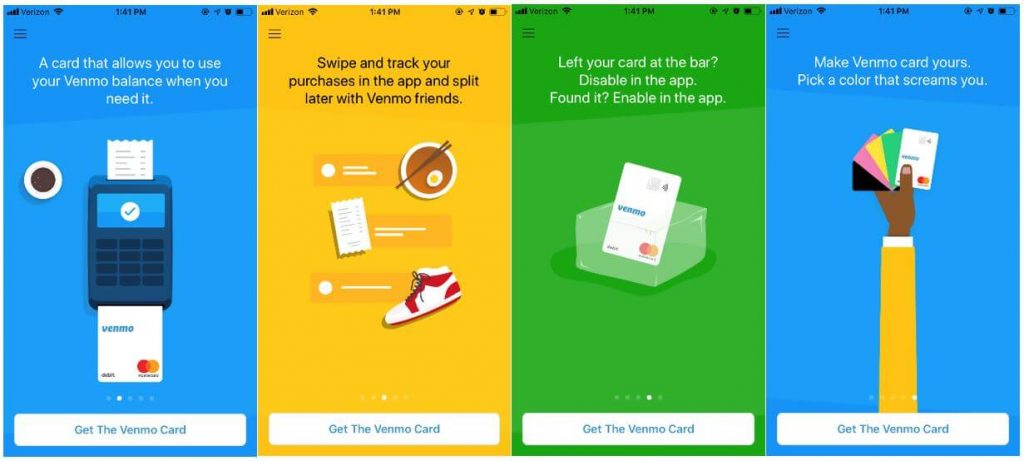

At the end of 2018, Venmo began promoting the cards to its user base in a series of emails and via in-app menus and screens. The marketing approach matched Venmo’s minimalist aesthetic:

When it comes to features and benefits, there is not much to this card. It’s a Mastercard debit, so you can use it to make purchases and get cash (but what Millennial will do that?). For extra security the card can be disabled through the app, which is fairly common for cards these days, but not universal.

So, what is the appeal? Users already have a linked bank account or credit card, so as The Daily Dot observed, the card is more like a middleman. But now very active Venmo users can keep their money in Venmo and spend it in the “real world” (one of the brand’s email headlines reads, “How to spend your Venmo money in the real world.”). For example, roommates who use Venmo to pool money for a utility bill can pay that bill with the debit card.

The obvious question for Venmo is, what’s next? Will it launch a co-brand credit card, like its parent company PayPal? If the core audience sticks with the app, it’s a good bet that it will continue to grow up with offerings to match its base’s upcoming life stages. But that’s a big if.

Chime helps customers build credit

Another financial brand that targets Millennials also seems to be evolving with its users. Chime was founded in 2013 as an online/app-only bank. Like Venmo, the company offers a simplified product with a streamlined UI. Chime avoids all of the typical, “traditional” checking account features that its Millennial userbase dislikes: there are no minimum balances, no account fees, no loans and no overdraft protections (which can lead to fees). Customers have a “spending account,” a savings account and a Visa debit card. The card includes an automatic saving program that rounds up debit transactions to the next dollar and deposits the difference into the savings account.

In January 2016, Chime had about 75,000 accounts. Fast forward to January 2019 and Chime now has over 750,000 accounts and is growing by 100,000 accounts per month. It seems that simplicity is paying off.

At the same time, it appears to be moving into new territory… credit. Last least year, Chime acquired Pinch, a company that helped customers (mainly Millennials) build a credit history by reporting on-time rent payments to the credit bureaus. Since debit cards don’t help with credit building, young customers who are heavy debit users struggle to build a robust credit history.

Chime is clearly thinking a few moves ahead. It framed the Pinch acquisition in terms of thinking about the “future set of products that we want to roll out.” So credit is now on the table… but what type of credit? Millennials are famously averse to credit cards and debt in general. Or rather, additional debt, owing to the fact that many have large balances on college loans. As they age, however, more Millennials will need a robust credit history for larger purchases, and Chime appears to be exploring ways to evolve with its customers and offer them a path to build that credit.

The key for both of these brands will be to stay true to their roots while evolving what they have to offer. Customers are fickle, and even the “disruptive” Millennials who have eschewed banking with “traditional” financial institutions could grow restless if they are not getting what they need.