Optimizing Onboarding ROI for Checking & Debit Accountholders

Banks and credit unions make considerable investments in acquisition – often spending anywhere from $200/$300 to $1000 or more per new accountholder. Without the right nurturing of those customers, many could slip away before even developing a relationship.

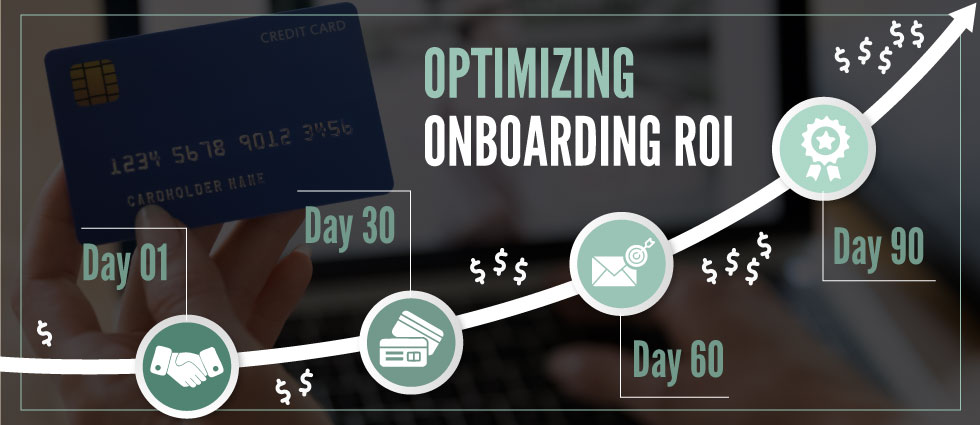

Nearly half of all customers who leave a bank do so within 90 days of opening an account.

But financial organizations that successfully navigate those first three months are likely to be rewarded with substantial returns over the long term. Research shows that the average checking relationship in the U.S. lasts nearly 18 years.

Obviously, it takes time to build a mutually beneficial (and profitable) relationship. The key to avoiding potential pitfalls and locking in a lifetime of customer value is to be ready on day one with an onboarding program optimized to deliver the best results.

Here are a few action items to keep in mind when considering an onboarding strategy:

Start building the relationship right away. From “thank you” and “welcome” messages to basic education and priming desired actions, frequent communications in the early stages offer a great opportunity to engage customers and deepen the relationship.

Nurture the debit card connection. Debit cards should be co-marketed with the customer’s checking account every step of the way. It represents an invaluable source of revenue.

Make every communication as relevant as possible. Develop and target communications based on specific actions your customers have (or have not) taken. It will help drive engagement, improve conversion rates, and create a better overall customer experience.

Let’s take a closer look at a successful customer journey (with a well-thought-out onboarding strategy).

No single program will be right for all situations, and generic onboarding efforts will only lead to irrelevant communications and missed opportunities. Building a successful onboarding program requires investment, planning, resources and strategy. But organizations that work to optimize their efforts from the start will be positioned well to create a lifetime of value.

Looking for specific best practices and onboarding tips? Download a PDF of Media Logic’s “90 days toward a lifetime of value” or download our “Onboarding Assessment Checklist” to see how prepared your organization.