Will Millennials Think Discover “chrome” Is “it”?

We covered the launch of the new Discover it card earlier this year, so we were interested to see an offshoot of the product tailored for college students. Taking direct aim at this important market, the Discover it “chrome” card proclaims that it’s “the card for college and beyond.” That’s a bold claim by Discover, so let’s take a closer look at how the card issuer backs it up.

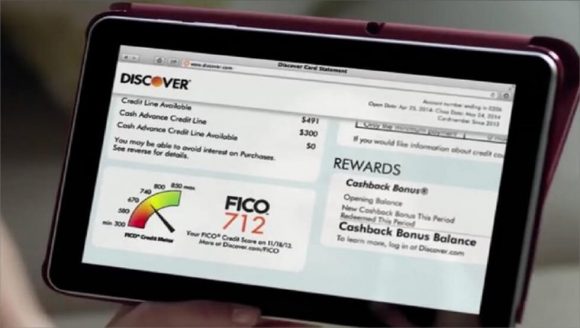

When we compare the “chrome” card to the core “it” card, there are almost no differences to speak of. Both offer a free FICO score online and in the monthly paper statement, both have security alerts and online/mobile account management tools, both have U.S.-based customer service, and both waive the fee for the first late payment.

The main difference is in the rewards. While both offer cash back (of course) that can also be used at Amazon.com, the two cards have different earn structures. The core “it” card offers a 5 percent bonus earn in select categories that change quarterly and 1 percent on everything else. For the student audience, Discover has a less robust, but more straightforward structure. The card earns 2 percent back on gas and at restaurants and 1 percent on everything else. The earn rate is likely reduced because students are largely still proving themselves to be creditworthy, and the set categories means they don’t have to keep track of where they get the bonus.

So what makes this a student card? We’re not really sure. While the FICO score, alerts and online tools could be beneficial for an audience still building credit history, there is little here that seems specifically designed for the college student market. The card does come with a few nifty card designs, but one of them is an audio cassette tape, a retro relic that anyone born after 1993 (i.e. the target audience for this card) has likely never owned.

The earn structure does not seem tailored to the either Millennial or student audiences. Two percent back on gas and restaurants is an odd choice given that Millennials have a declining rate of car ownership and have been pulling back on dining out over the last few years.

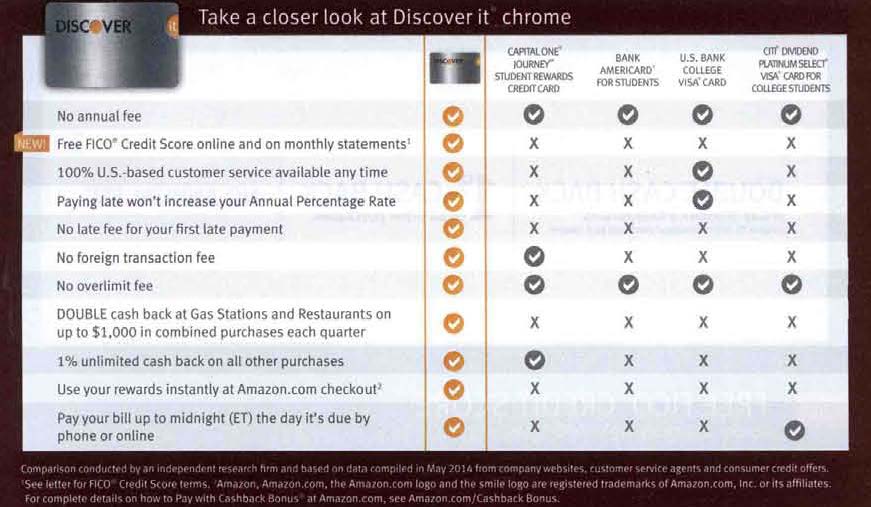

Discover does a good job of presenting this card to its target with clean design and clear messaging and making it look more attractive than the competitive set with a comparison chart used both in direct mail and online:

When viewed against competitive products from Bank of America, Capital One, U.S. Bank and Citi, “Discover it chrome” for students does offer more. And it’s also getting positive reviews – both Money Magazine and The Simple Dollar list the card as one of the top picks for students.

So yes, “chrome” is rich in features that other student cards do not have. But are they the features that Millennials want?

Like other major banks, Discover is not offering anything truly unique or differentiated to this segment. What banks have are largely stripped-down versions of mass market cards with a student spin. We’ve observed that banks need to take steps to stop this generation from “ditching” credit cards because – with innovative products like Magnises and GoBank – Millennials are “disrupting” the banking and payment industries. So when these legacy issuers offer students the same products that are offered everyone, simply dressed up as student cards with creative messaging (“for college and beyond”), it lacks authenticity because the cards offer nothing unique. (And when marketing to Millennials, authenticity is extremely important.)

While we are happy to see an issuer trying to think about product migration (beyond college), Discover seems to be missing a bigger opportunity. The most noticeable feature it has that other issuers lack is the free FICO score. For an audience still building credit, this is a useful tool. Using that as a starting point, Discover would identify additional features and benefits truly tailored with this audience in mind, find ways to meet its unique needs and solidify Discover’s spot as the market leader.

Millennials are showing that they are willing to find non-traditional players to fill their banking and payment needs if they don’t see products that appeal to them among the status quo, so issuers need to re-think how they approach product development or risk losing this audience before it establishes banking loyalties.