The 2022 Medicare AEP: Enrollment Numbers and Direct Mail Marketing Observations

Medicare Advantage (MA) remains the health insurance industry’s hottest market. Each year at Media Logic, we look at overall enrollment numbers to see which health insurers had substantial gains during the Annual Election Period (AEP). Our friends at Unite Us (Carrot Health) reported 3.8% overall MA market growth with the top 10 enrollment leaders accounting for 71% of this growth.

| Health Plan | Enrollment (December 2021) | Enrollment (January 2022) | Change (by number) | Change (by percent) |

| UnitedHealthcare | 4,291,777 | 4,459,576 | 167,799 | 3.9% |

| Aetna Medicare | 1,667,260 | 1,776,939 | 109,679 | 6.6% |

| Wellcare | 650,988 | 753,021 | 102,033 | 15.7% |

| Kaiser Permanente | 1,060,743 | 1,131,364 | 70,621 | 6.7% |

| Humana | 3,650,188 | 3,698,380 | 48,192 | 1.3% |

| Anthem Blue Cross Blue Shield | 428,119 | 472,358 | 44,239 | 10.3% |

| Amerigroup | 12,558 | 56,220 | 43,662 | 347.7% |

| SCAN Health Plan | 188,355 | 226,604 | 38,249 | 20.3% |

| Wellcare by Allwell | 75,096 | 102,884 | 27,788 | 37.0% |

| Blue Cross Blue Shield of Minnesota | 116,755 | 137,048 | 20,293 | 17.4% |

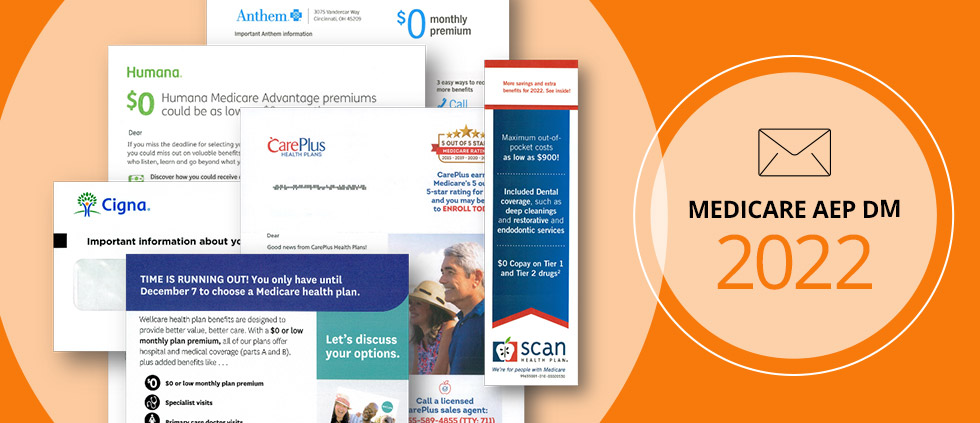

Not only do we review overall enrollment numbers to see which health insurers had substantial enrollment gains, but we also compile creative examples* of these plan’s direct mail marketing efforts. Why direct mail? There are two main reasons:

- Direct mail remains one of the most common shopping prompts during the 2022 AEP, according to Deft Research.

- While direct mail is only one of many marketing tactics used by health insurers during AEP, it can incorporate a lot of detail, providing a good lens for us to look closely at how MA plans are positioning themselves.

Here are six observations we made in reviewing direct mail samples from MA plans with top enrollment gains during the 2022 AEP:

- Prevalence of letter packages versus self-mailers.

- Outer envelopes were more straightforward with minimal branding and promotional language

- The amount of information included seems to be less than in previous years, and it is presented in a more simplified format. This is probably to address research that shows Medicare prospects are reaching information overload.

- Emphasis on $0 premium is still king but is almost always closely tied with other plan benefits. This is most likely because most competitors also have a $0 plan.

- Color is used sparingly, but when used it is effective in drawing attention to key messaging.

- The primary call to action is to call to learn more.

If you are a Medicare Advantage plan looking for a strategic partner for Medicare AEP marketing, let us connect. Contact Jim McDonald, head of strategic growth at 518-940-4882.

*Direct mail communications (screenshots) sourced from Mintel – a leading market intelligence agency.