3 Common Themes Found in 2021 Medicare AEP Direct Mail Marketing Campaigns

The 2021 Medicare Annual Election Period (AEP) was one marked by the COVID-19 pandemic and a distracting political election season. But surprisingly, the market held up well says Deft Research. Overall Medicare Advantage (MA) switching remained consistent with the previous two years.

Each year at Media Logic, we look at overall enrollment numbers to see which health insurers had substantial enrollment gains. We also compile creative examples* of these plan’s direct mail marketing efforts. Direct mail is only one of many marketing tactics used by health insurers during AEP, but it can incorporate a lot of detail, providing a good lens for us to look closely at how MA plans are positioning themselves.

| Plan | Enrollment | Est. AEP Gain | % Change |

|---|---|---|---|

| UnitedHealthcare | 4,089,501 | 361,606 | 9.70% |

| Humana | 3,515,607 | 167,410 | 5.00% |

| WellCare | 519,347 | 91,901 | 21.50% |

| Cigna | 446,019 | 82,219 | 22.60% |

| Blue Shield of California | 143,206 | 53,422 | 59.50% |

| Aetna Medicare | 1,587,694 | 46,244 | 3.00% |

| Anthem Blue Cross and Blue Shield | 413,883 | 27,798 | 7.20% |

| Kaiser Permanente | 1,009,591 | 13,939 | 1.40% |

| Blue Cross Blue Shield of Minnesota | 108,379 | 11,956 | 12.40% |

| Anthem HealthKeepers | 89,724 | 11,499 | 14.70% |

| Allwell | 68,406 | 10,825 | 18.80% |

| Devoted Health | 30,358 | 10,133 | 50.10% |

| Priority Health Medicare | 166,732 | 10,029 | 6.40% |

| Care N’ Care Insurance Company | 13,961 | 9,848 | 239.40% |

| Alignment Health Plan | 75,311 | 8,899 | 13.40% |

Of course, we know that marketing elements play just a part in each brand’s enrollment growth; many additional factors come into play. These include market competition, broker commission/incentives, mergers & acquisitions, the structure of plans themselves, along with other components ranging from pricing and plan benefits to the plan’s provider network.

With all of this in mind, we found three common themes in our review of 2021 Medicare AEP direct mail marketing campaigns:

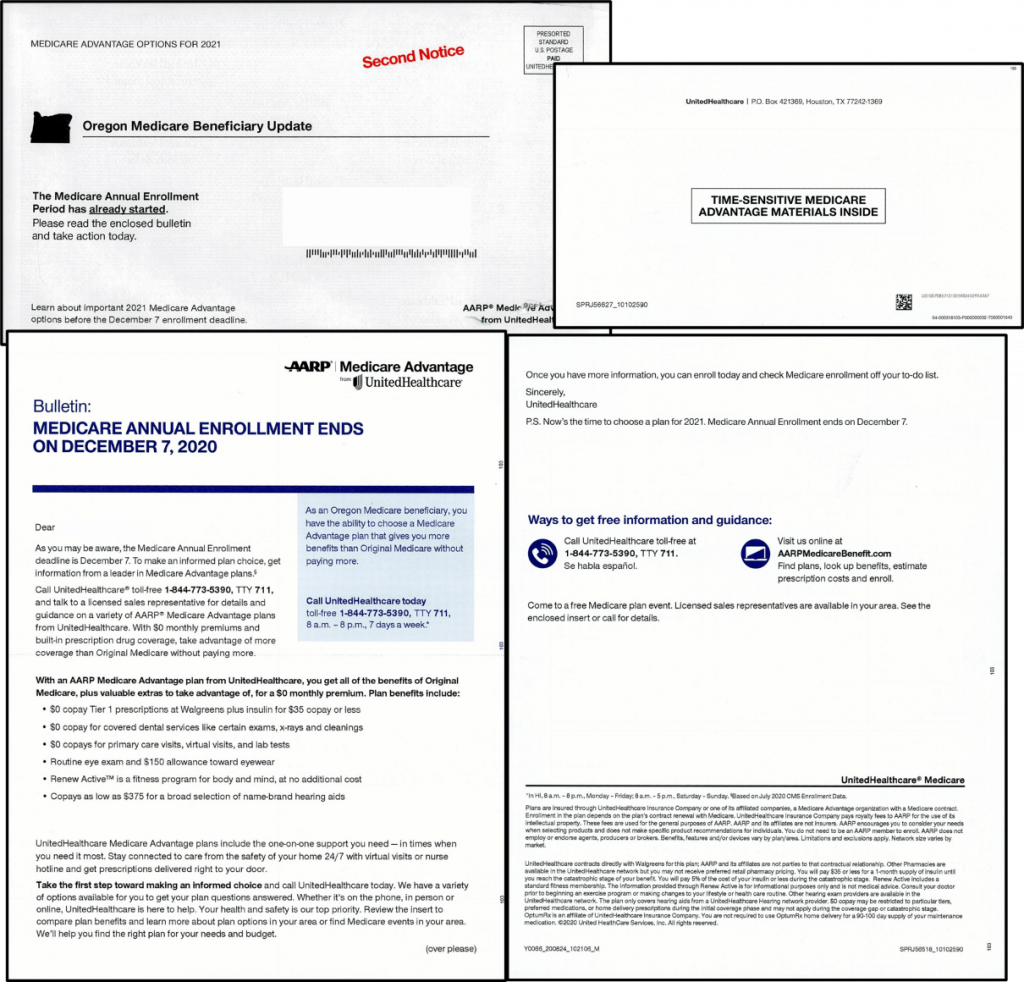

1. Urgency

In the examples below from UnitedHealthcare, we see an official-looking and discreet outer envelopment conveying a sense of urgency along with a related statement of benefits that resembles a stock certificate.

Our takeaway: This tactic plays to consumers’ fears. Overall, this “faux-official” approach can be effective, but there are concerns about ultimately undercutting a consumer’s trust. Such an approach could hurt the brand.

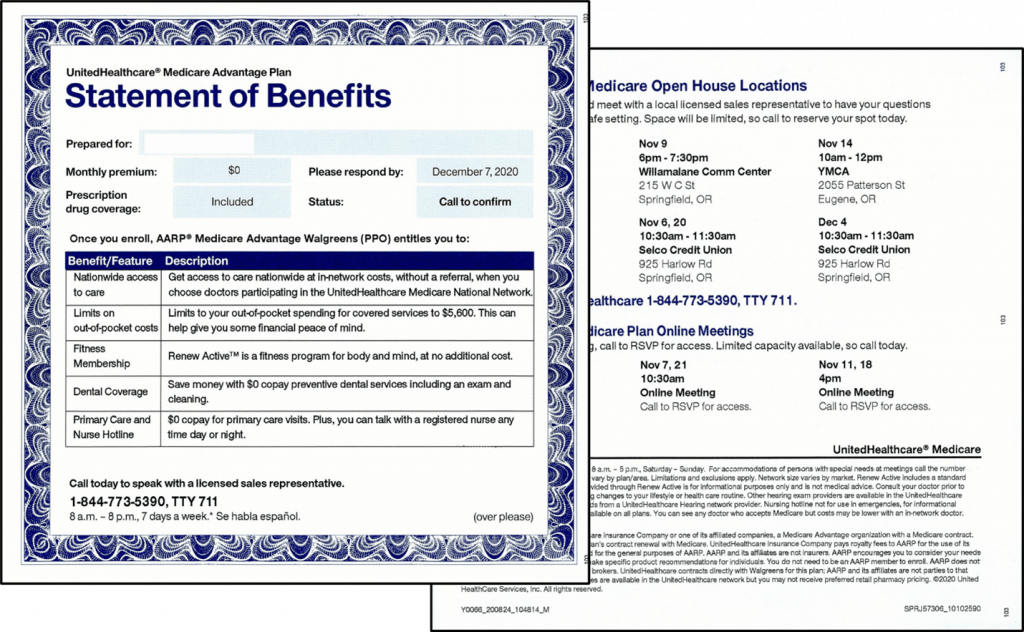

2. Reassurance

In this provider co-marketing example from Humana below, the line “More access to the doctors you trust” stood out as a strong line that speaks to the strength of the MA plan’s provider network and implies a more personal connection.

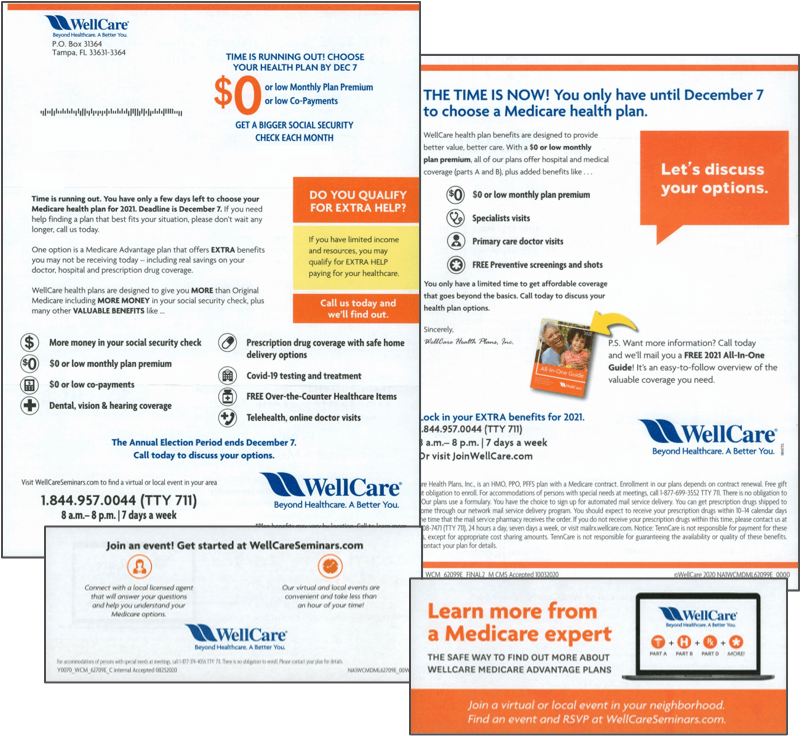

This letter package from WellCare includes a sidebar callout on finding out if a prospect might qualify for the Extra Help program. This stood out as messaging that could be extra impactful and effective after this past year.

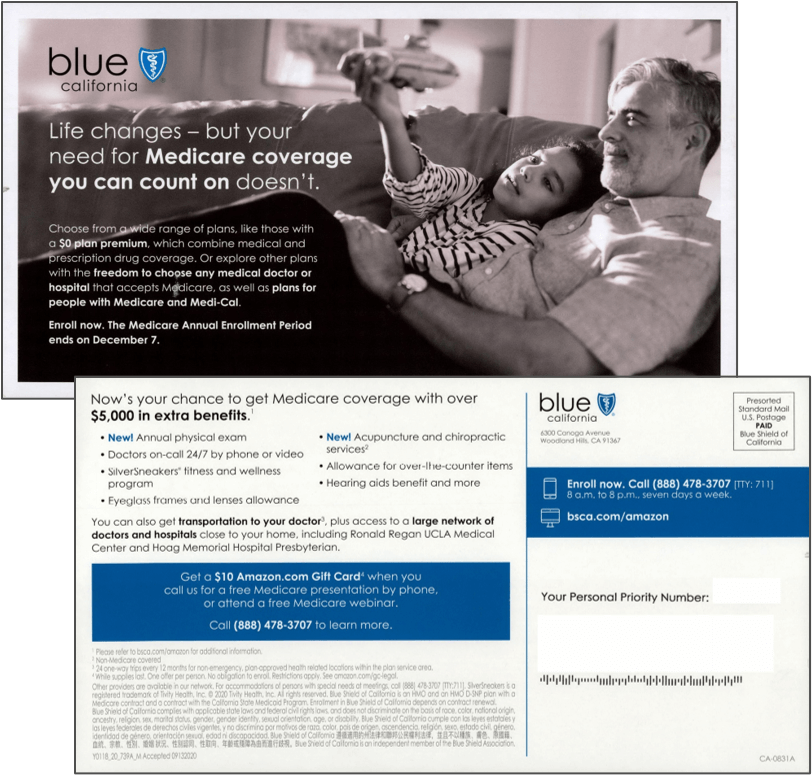

The overall feel of this Blue Shield of California postcard self-mailer stood out. The message “Life changes – but your need for Medicare coverage you can count on doesn’t” strikes a good tone after a challenging 2020.

Our takeaway: Insurers are sympathetic to consumers’ emotional and financial state of mind. They provide reassuring and supportive messaging along with emphasizing financial assistance and cost savings.

3. Simplicity

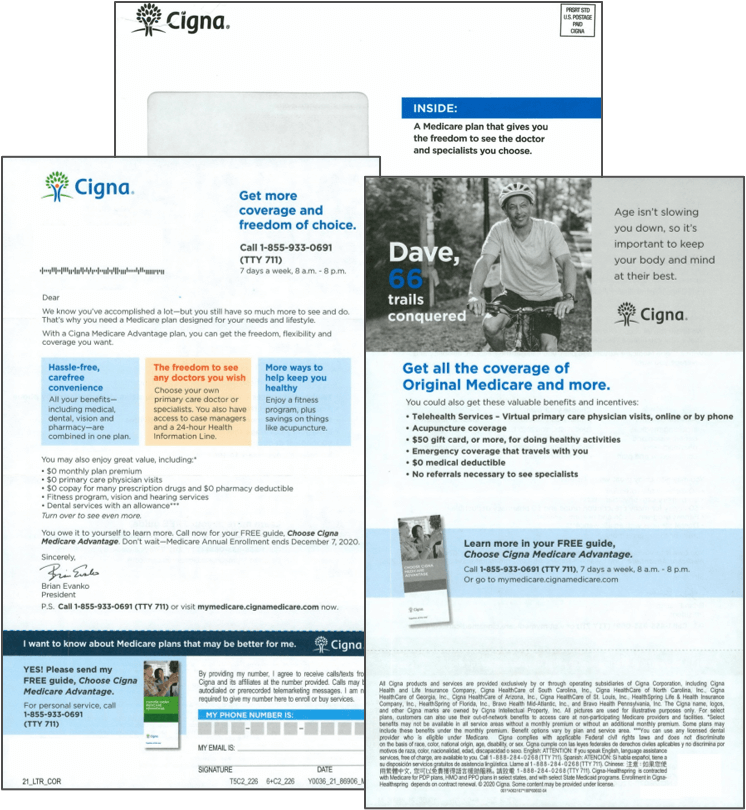

This letter package from Cigna leads with a message of flexibility including network choice and coverage extras. The use of the three boxes in the letter presents a clear, friendly way to carve out some personality and present a more holistic offering.

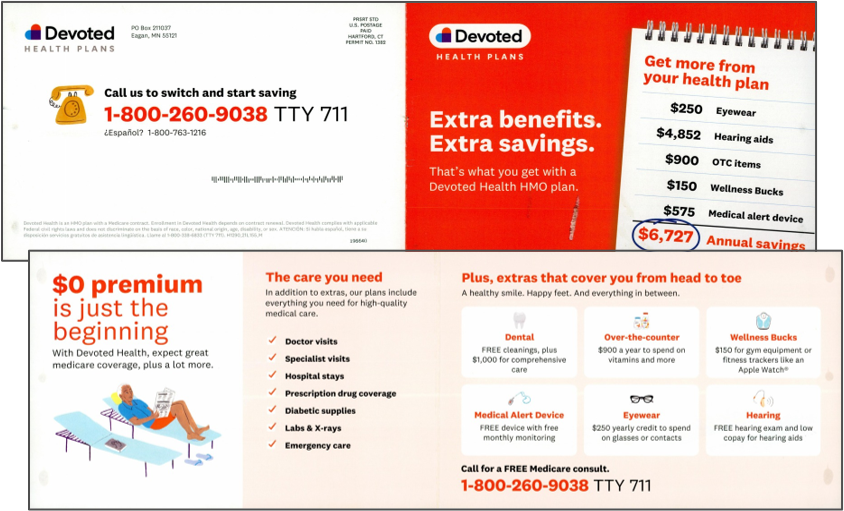

In their self-mailer, Devoted Health Plans gives a fresh and simple approach to highlighting the annual savings and overall benefits offerings without overloading on copy.

Our takeaway: It is difficult to stand out in the “sea of sameness” with a number of MA plans offering $0 premiums and supplemental benefits. Insurers need to take advantage of clean formatting and unique designs to quickly get consumers’ attention.

If you are a Medicare Advantage plan looking for a strategic partner for Medicare AEP marketing, let us connect. Contact Jim McDonald, head of strategic growth at 518-940-4882.

*Direct mail communications (screenshots) sourced from Mintel – a leading market intelligence agency.