Insurers Turn to Mobile Technology to Increase Customer Engagement

Insurers must find innovative ways to engage their customers. And Fierce HealthPayer directs insurers to an ally that insurers have yet to embrace fully: mobile technology.

Going so far as to describe this kind of customer engagement as “imperative,” a recent piece in HealthPayer attributes the expectation to the Affordable Care Act (ACA), which “created a humming individual market, putting an unprecedented amount of power in consumers’ hands when it comes to choosing and using their health insurance.”

So how does mobile come into play? First, it’s what consumers want and expect. Nearly two-thirds of consumers express interest in mobile apps and websites provided by an insurer, and more than 4 in 10 believe mobile is an important offering (source: IntelliResponse). Second, as HealthPayer reports, mobile has proven an effective channel for D-I-Y triage, health literacy and member portals.

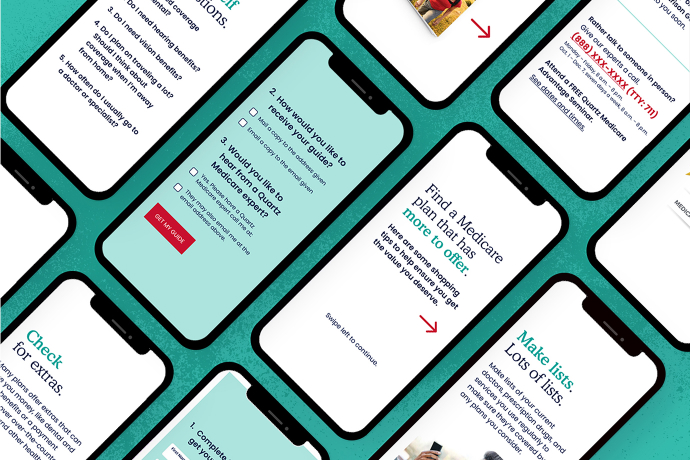

While most payers have mobile apps, the question is whether or not they meet consumer needs and expectations. Without discounting the value of apps that provide users with easy access to relevant tasks and functions, insurer apps can be more than utilitarian. They have the potential to do more than mimic desktop portals. Our advice for insurers is to explore mobile engagement more deeply to create a brand experience that will set them apart.

As we detail in this video, there’s currently great opportunity for insurers make things better and easier for customers. More and more that means developing the right mobile and digital tools: