Naming “Narrow Networks” – How Nomenclature, Communication Can Ease the Transition

What’s in a name? That which we call a rose

By any other name would smell as sweet

In The Bard’s immortal words, Juliet declares that a name is inconsequential… it is the essential character of something that defines it. But how would everyone’s favorite Capulet feel about transitioning from a traditional broad network health plan to a narrow network plan? And would she feel better about this change if the plan was named a “Select Network Plan,” a “Choice Network Plan” or any number of variations on a theme?

My doctor choices, thou hast limited

Wherefore are thou, specialists?

Whether they, indeed, smell as sweet, so-called narrow network products are here to stay. Although health insurers have offered them for years – typically as a lower-cost option for small businesses – the Affordable Care Act has brought narrow network plans to the fore.

According to a study by consulting firm McKinsey & Co., about 70% of plans sold on the exchanges in 2014 featured a limited network. McKinsey further reported that almost 20% of plans offered on the exchanges last year were “ultra-narrow networks,” giving consumers even fewer doctor and hospital choices.

The reason for the rising popularity of narrow networks is not surprising: their premiums were up to 17% less expensive than plans with broader networks. In a shopping environment (health exchange websites) where the majority of consumers are focused on monthly premiums, these plans have a decided advantage. And for many people, a well-constructed narrow network with sufficient access to services and specialists can be a smart option.

Much like in the star-crossed tale of Romeo and Juliet, however, there are significant obstacles to this relationship.

In the February 2014 Kaiser Health Tracking Poll from the Kaiser Family Foundation, 51% of respondents would prefer more expensive plans in order to have access to a broader network (compared to 37% who would sacrifice provider choice for lower premiums). Even worse, there is a growing backlash of consumer advocacy (including high-profile lawsuits and proposed legislation) for people who believe they’ve been duped into a narrow network option with insufficient provider access.

So how can health insurers continue to offer these increasingly popular products without disappointing (or, according to some, outright deceiving) consumers? The answer may, contrary to Juliet, be all in the name.

Schools of thought

In looking at some of the naming conventions employed nationwide for narrow networks, there appear to be three basic schools of thought: Keep It On-Brand, Make It Sound Special and Call A Fish A Fish.

In the Keep It On-Brand category, the name generally does not describe the narrow network concept – it simply works within an existing, brand-driven naming convention. For instance, Blue Shield of California’s “Blue Groove” portfolio includes narrow network offerings. Whereas “Basic Groove” is a traditional PPO with broad network access, “Main Groove” is a narrow network product of “high-performing providers” (providers who meet the insurer’s standards for best practices). Similarly, Blue Cross Blue Shield of Minnesota has developed “BluePrint,” a narrow “network of top professionals” who deliver “the right care, at the right time and place.”

Other narrow network names use the Make It Sound Special approach, which involves giving the product more of a marketing spin. For instance, the “Aetna Signature Network” borrows a page from the credit card industry, where the word “signature” implies access to exclusive or unique benefits. Similarly, Minnesota’s HealthPartners offers something called the “Select Choice Network,” a name that connotes special or hand-picked providers – versus limited provider access.

Finally, there are insurers who keep their narrow network naming simple – those who Call A Fish A Fish. “Cigna LocalPlus” offers in-network access to providers in select metropolitan areas (“Local”) with the option to see providers in Cigna’s Open Access Plus Network (“Plus”) at higher out-of-pocket costs. And then there are names like Anthem’s “PPO Select Narrow Hospital Network Option,” which require little explanation.

The preferred approach

So, when it comes to naming narrow networks, what is the preferred approach? Clarity. Simplicity. Transparency. As insurers are increasingly recognizing the role of healthcare literacy in combating low retention rates on the exchanges, Call A Fish A Fish is the right choice.

Whether the plan variable is coinsurance, deductible or network size, insurers must avoid obfuscation during open enrollment to minimize down-the-road disappointment. You may even want to include language that states that these plans are not for everybody – that it depends on your personal provider needs, etc. – to encourage prospects to thoroughly vet their doctor and hospital choices. If your customers better understand what they’re buying, what it does and what it doesn’t do, they’re more likely to stay with you.

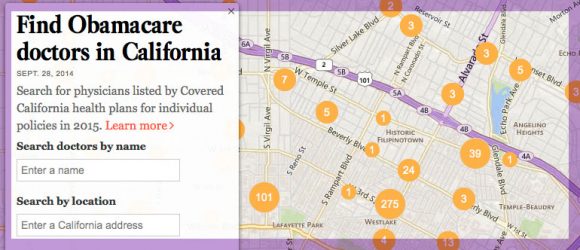

Beyond naming, your website and other communication materials need to convey how your narrow networks work. If you offer a range of network options, make it easy for consumers to compare the differences – the same way rental car companies are exceedingly clear about the differences between a compact, a full-size and an SUV. And make sure that your online provider search enables consumers to quickly determine whether their doctors are in each of your networks (many health insurance web sites make this an unnecessarily complex process).

When thoughtfully constructed, narrow network plans can be an appealing and affordable option for consumers and employers – and they are likely to continue gaining market share. But your narrow network plans are far less likely to meet Juliet’s tragic fate if supported by clear naming and strong communication.