Research Study: How Regional and Local Health Insurers Can Take on the Nationals

For-profit national health insurers have long dominated the market. And yet, there are hundreds of regional and local payers that continue to find success in nearly every MSA in the U.S. The answer to how and why both co-exist is driven by the mindsets of the consumers they serve. This inspired our Consumer In Sight research team to conduct a study on how consumers view national and regional/local insurers – their perceptions, expectations and preferences.

The majority, 59%, are indifferent and had no stated preference between national or regional and local health insurers. However, for those who stated a preference, 31% chose national compared to just 9% for regional/local.

We think this may be an indication that regional and local health insurers need to do a better job leveraging some of their inherently unique characteristics when telling their stories and positioning their brands. And we hope these findings inspire some regional/local insurers to do just that.

Key findings:

Consumers want their health insurer to understand the needs of their community, and regional/local payers are better at it.

- 50% of respondents said it’s “very” or “extremely” important for their health insurance company to understand the needs of their local community. When including respondents who said it’s “moderately” important, that number increases to 80%.

- 54% agree that health insurance companies based in their community better understand the needs of the community.

Consumers want their health insurer to support groups and activities in their community.

- 55% feel it is “very” or “extremely” important that health insurers support health and wellness events, like health screenings, walks and expos. When “moderately” important is included, that number increased to 80%. And 74% of those who have attended such events feel it has positively influenced their perception of the sponsoring insurer.

- 42% feel it is “very” or “extremely” important that health insurers support community improvement programs. When “moderately” important is included, the number increased to 72%.

- 36% feel it is “very” or “extremely” important that health insurers support local charities. When “moderately” important is included, the number increased to 68%.

- 36% feel it is “very” or “extremely” important that health insurers support school events or programs. When “moderately” important is included, the number increased to 67%.

Being a not-for-profit makes a difference.

- 30% of respondents said it was “very” or “extremely” important for their health insurance company to be a not-for-profit organization. When “moderately” important is included, that number increased to 66%.

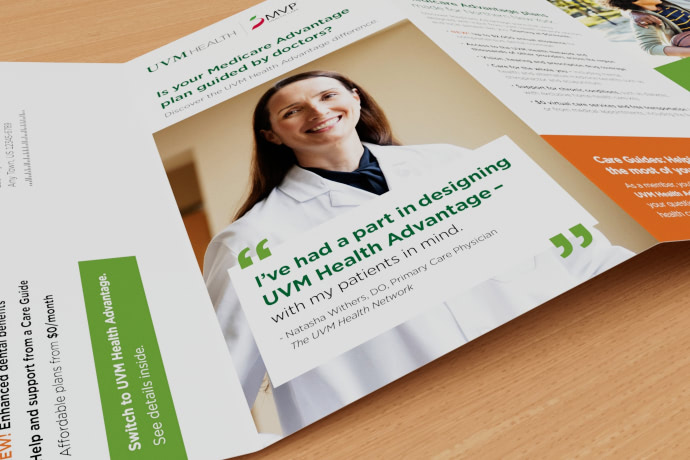

Being a “payvider” is a good thing.

- 58% of respondents would find it “somewhat” or “very appealing” for a health insurer to be owned by a health system or a hospital.

- 67% of respondents would find it “somewhat” or “very appealing” for a health insurer to be shaped and guided by doctors.

Advertising that is connected to the local community will make consumers feel positive about your brand.

- 69% of respondents said the inclusion of real local doctors and hospitals in advertising would make them feel “somewhat” or “very” positive about the insurer.

- 63% of respondents said the inclusion of local member testimonials or stories in advertising would make them feel “somewhat” or “very” positive about the insurer.

- 56% of respondents said the inclusion of local scenes in advertising would make them feel “somewhat” or “very” positive about the insurer.

View all the survey findings below. You can also download a PDF version of the deck.

For more insights, check out our recent blog posts about the value of vertical video in healthcare content marketing and the media habits of older adults in 2024. Stay tuned for more surveys and strategic takeaways from the Consumer In Sight research team throughout the year.

Any questions? Reach out to Media Logic today.