Wells Fargo Gets Out Ahead of Competitors With Cardless ATM Push

Cardless ATMs are among those “banking innovations” that have been long-touted, but so far failed to break though. They have been making the rounds at industry conferences since 2011, and yet, over five years later, they are still not common in most branches. But now, with Bank of America, Chase and Wells Fargo all making strong pushes to adopt the cardless ATM, 2017 is likely to be the year that begins to change.

So what is a cardless ATM? The name really says it all. Customers use their banks’ mobile app to set up a withdrawal. Instead of using their cards at the ATMs when they arrive at their branches, they use their phones (via NFC or one-time codes) to get their cash. It’s the ATM version of mobile payments like Apple Pay or Android Pay and the natural companion to mobile check deposits, which are almost ubiquitous.

Banks like cardless ATM withdrawals because they give customers another reason to use the banks’ mobile app. The transactions provide added security with a way to help to combat the recent rise in ATM card “skimming.” And of course, the new technology gives banks both big and small opportunities to showcase “innovation.”

And yet, other than press releases and tons of industry news, there is very little being showcased by the leading banks. Bank of America, Chase and Citibank have all talked about rollout plans, but at this point they are running behind. That’s because in late March, Wells Fargo announced that it had rolled out “card-free access to all of its 13,000 ATMs, coast-to-coast.” And Wells Fargo has backed up this effort with a multi-channel marketing push in Q2.

The day after the announcement, Wells Fargo posted a “how to” video on Facebook and linked to a blog post (which highlighted “innovation,” of course):

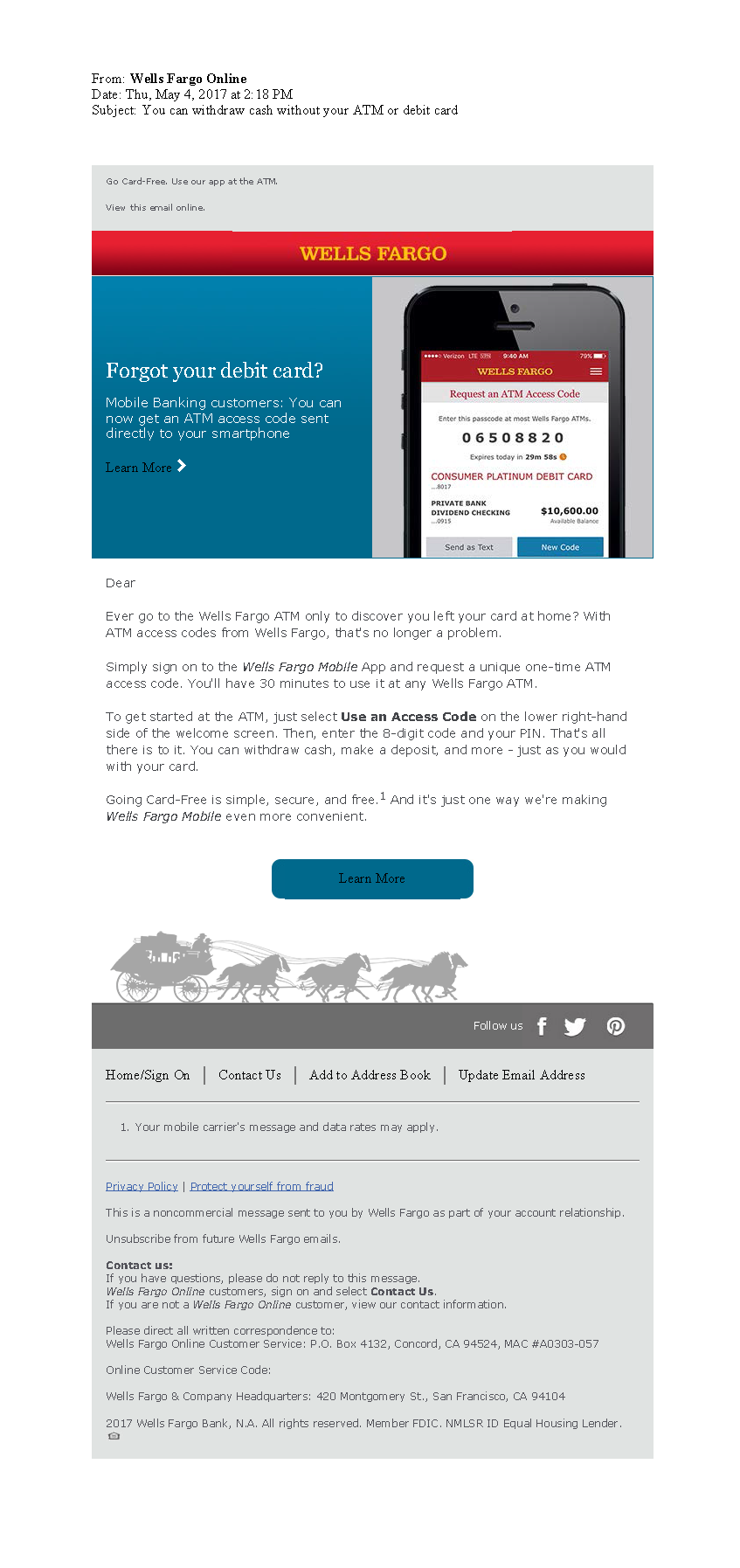

Wells Fargo has also used email to alert current banking customers about the new feature.

Perhaps most interesting part of the marketing campaign is that Wells Fargo has launched a broadcast campaign to highlight what it calls “Card Free ATM Access.” There is a short pre-roll ad …

… and a few 30-second spots running both on “traditional” TV and streaming services.

The blink-and-you’ll-miss-it call-to-action directs viewers to wellsfargo.com/better, a microsite that highlights the bank’s products and good works. The tagline, “Building better every day” could be seen as one part declaration and one part mea culpa. That aside, the focus on cardless ATMs is a logical choice for Wells Fargo. The bank is out ahead of the competition both with the nationwide roll-out at 13,000 ATMs and with the advertising to tout this innovation. To be fair, that first mover status might be due to its use of the one-time code instead of NFC integration (which is “coming soon”), but that may not matter too much to customers.

With its PR challenges this past year, Wells Fargo could benefit from some good news to announce, and cardless ATMs give them an opportunity to launch a new (and innovative) feature with a clear and tangible customer benefit: convenience.

And with more banks rolling out cardless ATMs, we should expect to see more marketing campaigns like this over the course of the year.