The Importance of an Early Month on Book (EMOB) Strategy

Our latest infographic shows why EMOB marketing works. Let it inspire and motivate you to push five key activities with cardholders in their first 90 days!

Payment card manufacturer CPI was preparing to introduce a new product to its line of Card@Once instant issuance card printers. But before the new printer was launched, they wanted to lay some groundwork for both existing customers and new prospects with an online campaign focused on more generic messaging tied to their existing “Precision” printer.

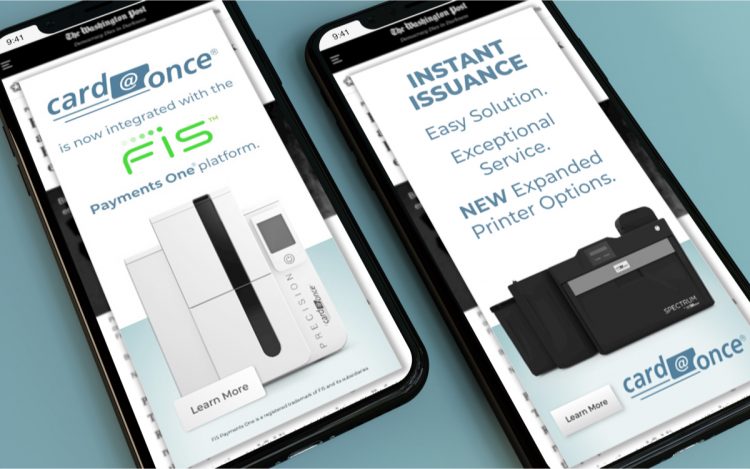

Media Logic developed the strategy, creative, design and media plan for a targeted digital campaign consisting of multiple display banners and messaging ads – all driving to a dedicated Card@Once product landing page. A range of ads was placed on digital publications included in the media buy, each selected based on their reach into the financial service industries of our specific target audiences. For tracking purposes, each ad was also assigned a unique UTM code.

The ads themselves promoted CPI’s instant issuance capabilities, speaking to Card@Once’s ease of use and cloud-based capabilities – with the existing printer primarily represented through photography.

Ready to find your edge?

Get smarter strategy and breakthrough creative. Backed by unmatched client support.

Our latest infographic shows why EMOB marketing works. Let it inspire and motivate you to push five key activities with cardholders in their first 90 days!

Despite market challenges, co-brand credit cards are poised for significant growth through 2030. With only 25% of U.S. consumers currently holding co-brand cards (versus 69% with general-purpose cards), issuers face substantial acquisition opportunities. Strategic targeting of underrepresented segments—particularly higher-income consumers and younger demographics—presents immediate growth potential. Find out how forward-thinking issuers will leverage data-driven personalization, fintech partnerships, and innovative payment flexibility to differentiate their offerings in this dynamic, competitive landscape.

Throughout 2024, we explored topics ranging from emerging payment trends to audience segmentation strategies, offering insights to help financial brands navigate an increasingly competitive landscape. Here's a look at the top 10 articles from this year, covering key themes and takeaways that shaped financial marketing in 2024.